Intro To Nonprofit Accounting: Lesson 6

Learn what internal controls are when it comes to accounting and how you can use them to protect your nonprofit. In previous lessons, we covered how to create and use an accounting system, and how to use that system to pull required financial reports. Now we will look at protecting your organization from financial crisis, and establishing a standard of transparency and accountability. If you work for a nonprofit, this lesson is for you.

What Is An Internal Control?

An internal control is a process that protects both the assets and people of a nonprofit.

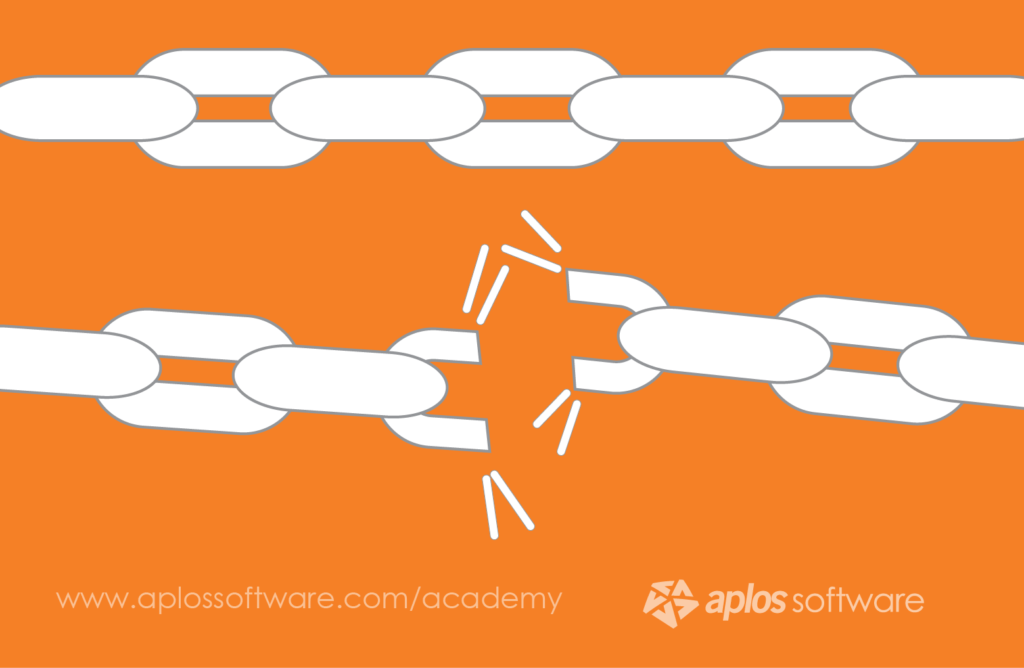

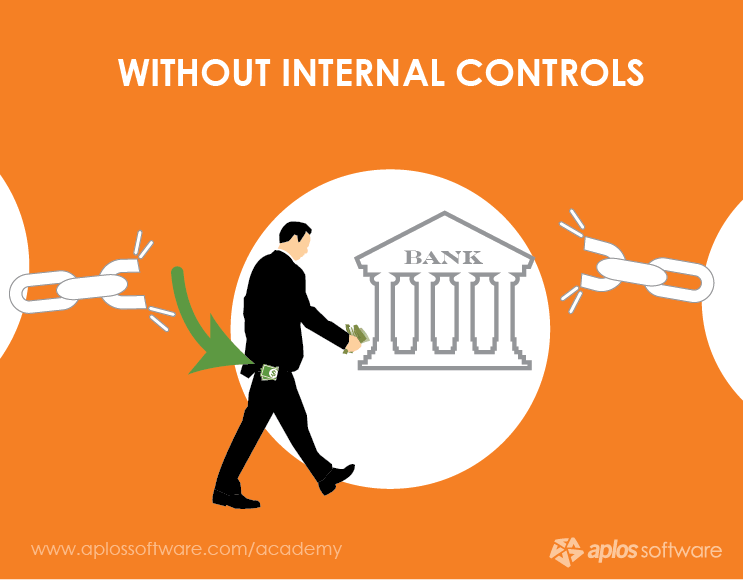

A nonprofit doesn’t simply have one internal control but rather a system of them. Think of a chain that holds the entire system together. Together, the links are strong and achieve their purpose. However, one break compromises the integrity of the entire chain. As they say, “a chain is only as strong as its weakest link.”

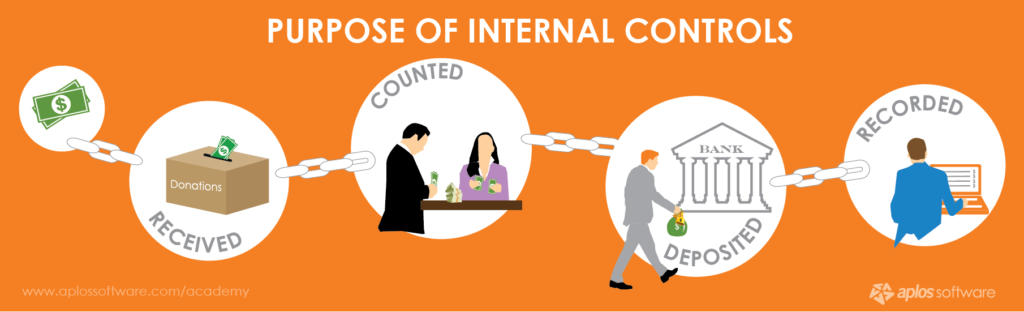

For example, let’s say your nonprofit throws a fundraiser that uses donation buckets to collect money. At the end of the fundraiser, this money is gathered, counted, and deposited into the bank. This income also makes its way into your accounting records. It is then reported on an income statement showing the profit from this fundraiser.

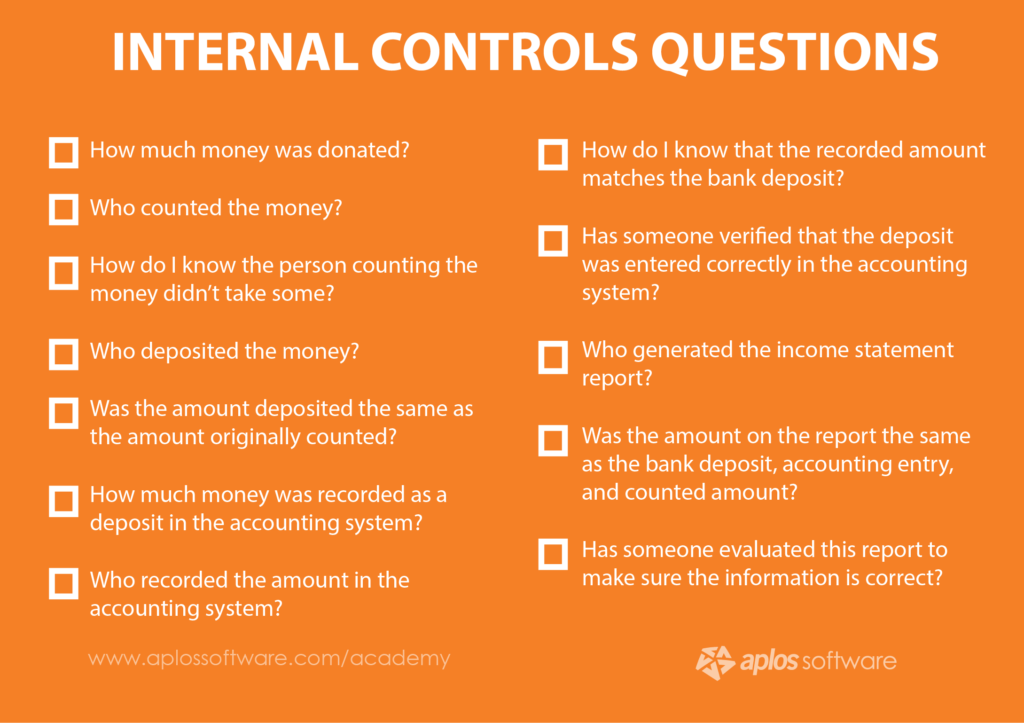

Here are some questions you might ask when trying to create internal controls for this fundraiser:

Each of these questions needs an answer, and each answer represents an internal control you can and should put in place.

Let’s say the person who counted the money took some. Without internal controls for that process, there would be no way of knowing. Your nonprofit’s assets (people’s donations) have been compromised. So have the reputation and integrity of the person counting the money.

Protecting Your Organization

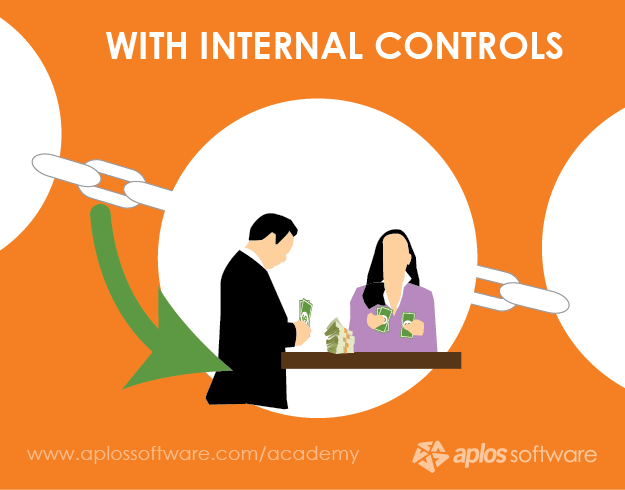

An internal control for this step would require two people to count the money together. This would protect the individuals counting from accusations of stealing and ensure an accurate count.

Now that money needs to be deposited in the bank, recorded in the accounting system, and reported.

Say the person who deposited the money was the same person who recorded the deposit in the accounting system. If this person decided to take some money out before depositing the money, they would be the one to record the deposit. Without internal controls, it would be very difficult to catch them.

An internal control for this step would be to have the two volunteers who counted the money place it in a secure bank deposit bag that the person depositing can’t access. So the two individuals who counted would secure the money, and a third person would deposit it. This third volunteer doesn’t have access to the money in the bag nor the ability to withdraw money from the bank. This protects the individual depositing the funds, and guarantees the money counted matches the amount deposited.

When accounting for the money in your organization, the examples go on and on, but remember, internal controls protect your assets and people. With a complete internal controls system in place you can rest easy knowing the chain is strong.

Protecting Your People

Many nonprofits avoid creating and implementing internal controls because they trust the people involved. They worry the internal control may make others feel like they are not trusted.

On the contrary, internal controls help protect your trusted employees or volunteers in case you are audited or detect fraud. If money does go missing and internal control activities were followed, you can be confident in those controls. There would be no need to suspect those people because they could not have taken the money without someone else knowing about it. Thus, you have protected your people from false accusations and mistrust.

What Next?

Having internal controls is extremely important for your nonprofit and will be vital to your success. We have touched on some basic principles of an internal control system. Stay tuned for our full course covering internal controls that will dive further into this topic. We will provide plenty of examples of how to structure an internal controls system for your nonprofit.

In the final lesson of this course, we will discuss rules and standards that go along with nonprofit accounting systems.