Intro To Nonprofit Accounting: Lesson 5

Ready to learn about nonprofit financial statements, a.k.a. reports? We will take a look at the two reports every organization needs, a third report nonprofits need, and other types of reports that can benefit your organization. If you have set up a chart of accounts and started to record transactions, this is the lesson for you.

What Are Financial Statements?

Over the past two lessons, we discussed how to begin structuring a nonprofit accounting system. First, you set up your chart of accounts, and then you use those accounts when recording transactions. Once those are complete, you can begin to generate reports based on the information you’ve recorded. When compiled in specific ways, these are referred to as your financial statements. Reports can vary from listing contacts to reviewing your transaction history, but there are two specific reports every organization needs to know.

Balance Sheet (Statement Of Financial Position)

The balance sheet, known as the statement of financial position for nonprofits, illustrates an accounting equation and shows a snapshot of your organization’s financial health. The accounting equation is:

Assets = Liability + Equity

What this means is the things you own (assets), equal the debt you have (liability), plus your overall worth (equity). An easier way to illustrate this is by saying the things you own, minus what you owe, equal your overall worth. When viewing this report, it will quickly show you if your organization owes more than it owns. This is the first of two reports every organization (nonprofit and for-profit) needs to provide.

Income Statement (Statement Of Activities)

The income statement is the second report every organization needs to provide, whether they are a nonprofit or for-profit. Known as the statement of activities for nonprofits, it shows the following formula:

Income – Expense = Net Income (Increase in Net Assets)

What this means is the money you receive, minus the money you spend, is called your net income (or the increase in net assets for a nonprofit). When viewing this report, it will quickly show whether your organization is making more than it’s spending.

Nonprofit Financial Statements

Nonprofits have unique guidelines for their reporting, which we will dive into in later lessons. In addition to the two reports noted above, nonprofits also must provide a statement of functional expenses.

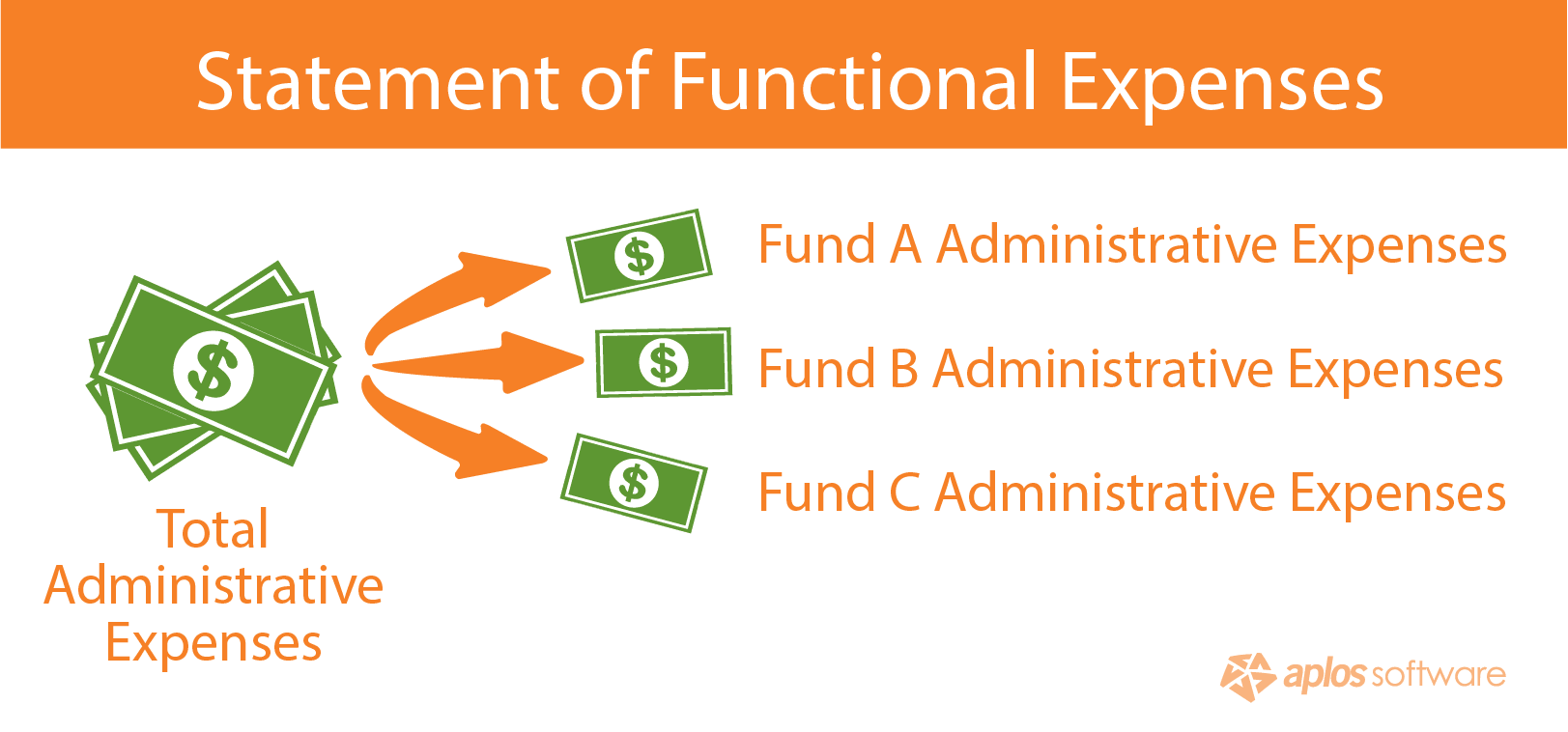

The statement of functional expenses is where fund accounting really begins to shine. This report shows not only how much money you’ve spent, but it breaks each expense down by fund and category. For instance, it would show the total administrative costs across your entire organization. It also shows how much each fund has spent using these accounts. Assuming you have created an effective chart of accounts and recorded everything properly, these reports should be very simple to create.

Other Reports

A report is really just a collection of data presented in a certain way. That being said, this can truly be anything you want to see about your nonprofit. The ability to generate different types of reports is going to come down to the amount of detail you have been recording, and the method you use to generate nonprofit financial statements.

When choosing software, you may want to glance at their reporting capabilities before making a decision. Especially for nonprofits, you want to choose software that will allow you to find the information you need quickly. Also, think through the other types of information you may want to see in a report. For instance, will you want or need to see how many people have given to a particular fund? Will you want or need to see how much you have received and spent on a fundraiser within a certain timeframe? Again, all of these reports will come down to the amount of detail you’ve been recording, and the capabilities of the software you’ve chosen to use.

What next?

A nonprofit accounting system begins with accounts that are used to record transactions, that then allow you to create nonprofit financial statements. This is essentially the nuts and bolts of any accounting system. Check out this article to explore other resources going over these reports. Now that you have a foundational understanding of these components, you can move forward in creating your own nonprofit accounting system.

In the next lesson, we’ll take a look at how to protect and maintain your accounting system. We will also go over the rules and guidelines you’ll need to adhere to as a nonprofit. The next few lessons won’t be as practically implemented as the previous few, but they’re still important for your nonprofit’s accounting system. In the meantime, if you’d like a more in-depth guide on nonprofit accounting, check out our Ultimate Guide To Nonprofit Accounting.

Free eBook: The Essential Reports Your Nonprofit Needs

When running a nonprofit, it is crucial to have a well-formulated system to get the exact reports your board is asking for. In this eBook, we go into detail about the essential reports nonprofits need. We also cover why the reports matter and demonstrate how to build and streamline these reports. You will learn:

- What the essential nonprofit reports are

- Best practices for creating reports to fit your organization’s needs

- How to customize your bookkeeping to make reporting simple

2 comments

[…] Have three minutes to watch the video lesson? […]

[…] Have three minutes to watch the video lesson? […]