What Is a Nonprofit Chart of Accounts?

A nonprofit chart of accounts for your organization is the list of each account that money comes into, or out of, in your organization. The word chart just makes it sound fancy. This list is created by your organization and will vary depending on your nonprofit’s needs. You can use our free nonprofit chart of accounts template to get started.

Your organization will only have one chart of accounts, so make sure to create one that makes sense for your operations.

Manage your giving, accounting, budgeting, and more with Aplos. Try it for free.

Examples of a Nonprofit Chart of Accounts

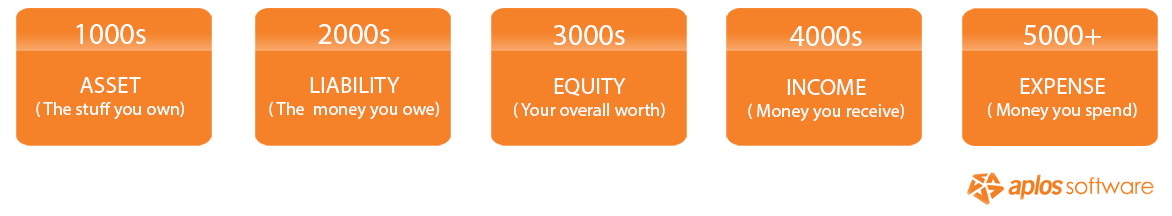

When accounts are created in an accounting system, they are organized using names and numbers. Account numbers are, for the most part, up to you and how you would like to organize them. However, the standard number ranges applied to each account is as follows:

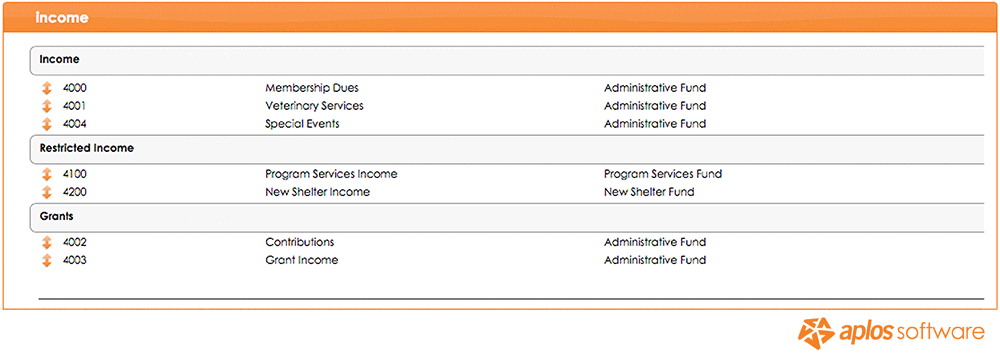

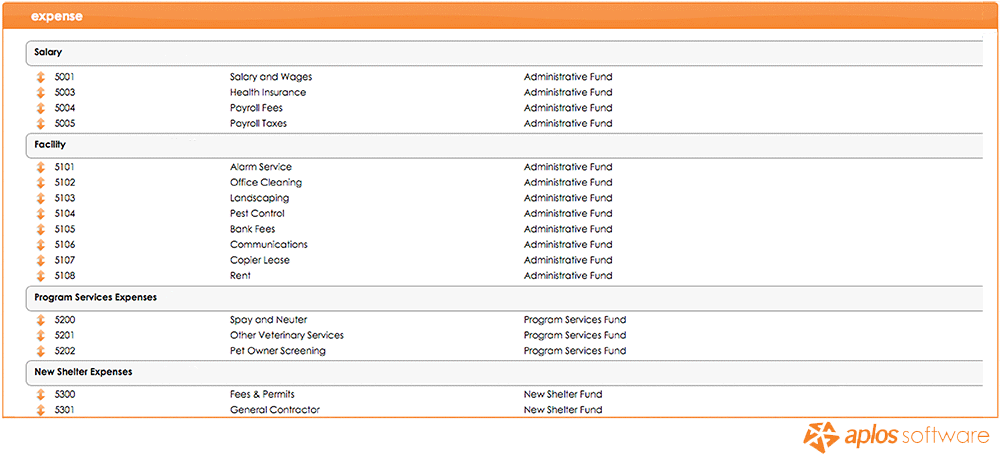

A nonprofit chart of accounts may be similar to this:

In other words, accounts represent these five areas of your organization’s finances that you’re tracking:

- Asset = what you own = 1000 range

- Liability = what you owe = 2000 range

- Equity = overall worth = 3000 range

- Income = money you get = 4000 range

- Expense = money you spend = 5000 range

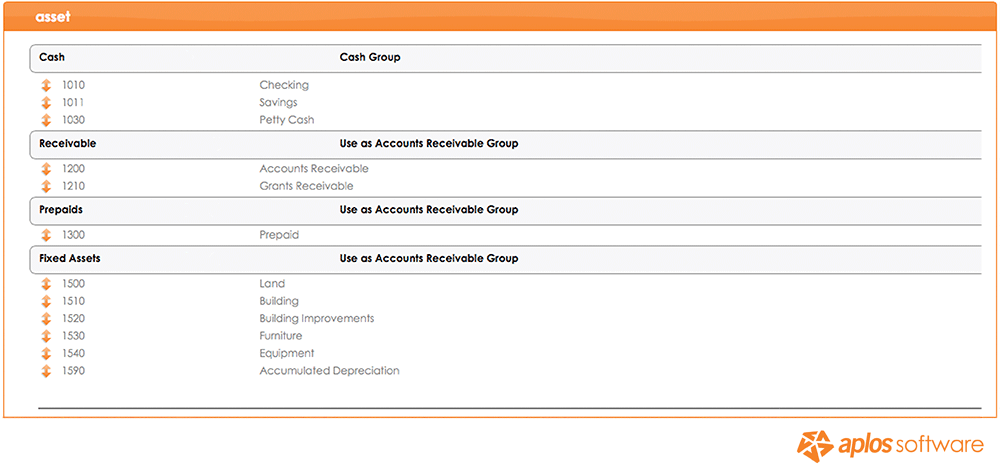

Common Nonprofit Asset Accounts

- Cash (checking, savings, and petty cash balances)

- Accounts receivable (invoices that you haven’t been paid for yet)

- Inventory (your stock of items’ value)

- Fixed Assets (land, vehicles, property, equipment, etc.)

- Other (investments, depreciation, long-term assets, etc.)

Asset accounts are numbered in the 1000 range, and their names will need to be descriptive. The number will be listed first, followed by a dash, then the account name. For example, “1000 – Checking.” This account’s number is 1000, and the name represents what it is, which is your checking account. This account will be used to track how much money is in your checking account. Below are a few more examples of other asset accounts:

- 1001 – Savings

- 1100 – Invoices Receivable

- 1200 – Inventory

- 1300 – Land

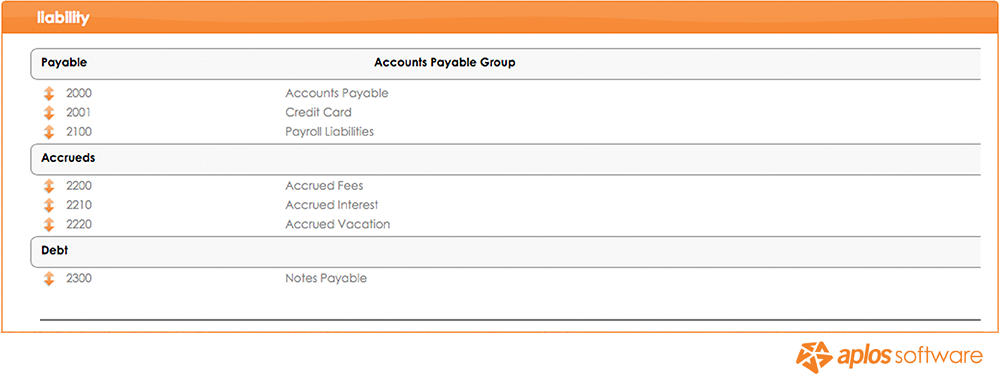

Common Nonprofit Liability Accounts

- Accounts payable (money you owe vendors or suppliers)

- Short-term debt (credit balances, short-term loans, etc.)

- Long-term debt (school loans, mortgage, etc.)

- Accrued liabilities (payroll taxes, wages payable, etc.)

Liability accounts are numbered in the 2000 range, and should have names that are reflective of what they are. For example, “2000 – Accounts Payable.” This account will be used to track the amount of money you owe others from invoices or bills you’ve received. Below are a few more examples of liability accounts:

- 2100 – Credit Card Balance

- 2200 – Property Mortgage

- 2201 – Vehicle Loan

- 2300 – Payroll Tax Payable

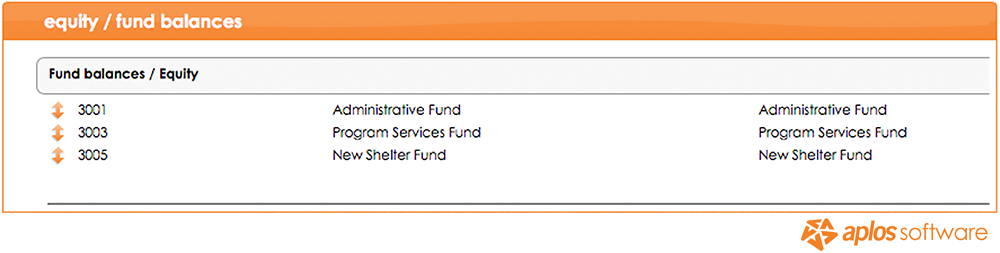

Common Nonprofit Equity Accounts

- Retained earnings (net income for your organization)

- Other equity (owner’s equity, stockholders’ equity, etc.)

- Funds with donor restrictions and funds without donor restrictions (nonprofit-specific)

- Fund balances (nonprofit-specific)

Equity is the value of your assets, minus your liabilities. In other words, it’s the value of your organization after your expenses and debts are deducted. This information is reflected on a Balance Sheet report. It’s where fund accounting emerges. If you need a recap of fund accounting, refer to our complete overview of What Is Fund Accounting?

A fund is a breakdown of your equity. The money you have and owe can be intended for a specific purpose (fund). Therefore, you will need an equity balance to represent the fund’s overall worth. If you know what funds need to be created, you can set each up as its own equity account. Equity is numbered in the 3000 range:

- 3000 – General Fund

- 3100 – Missions Fund

- 3200 – Building Fund

- 3300 – Special Projects Fund

Each of the above examples will have its own balance and value across your entire organization. It should be noted that there are further classifications for these funds per nonprofit standards. For now, just focus on creating equity accounts for each of your funds so you can continue through the setup.

Common Nonprofit Income Accounts

- Donations (gifts, special offerings)

- Pledges (money promised to you by a donor)

- Grants (money you’ve received for a specific purpose)

- Revenue (received from selling an item or performing a service)

Income accounts are numbered in the 4000 range, and likewise should have names that are reflective of how or where you get the money. For example, “4000 – Donations Income.” This account will be used to track the money you receive from donations. Below are a few more examples of income accounts:

- 4001 – Designated Donations

- 4100 – Pledge Income

- 4200 – Grant Income

- 4300 – Sales Revenue

Common Nonprofit Expense Accounts

- Everyday expenses (office supplies, printing cost, salary, etc.)

- Bills (rent, utilities, purchase orders, etc.)

- Program expenses (fundraiser supplies, program vendors, etc.)

- Other expenses (meals/entertainment, fees, health bills, etc.)

Expense accounts are numbered in the 5000+ range, which means they can range from 5000 onward. Typically you will have more expense accounts than any other type of account, so the number range allows for growth. Like the other accounts, expense accounts should have names that are reflective of how or where you spend money. For example, “5000 – Salary Expense.” Below are some more examples of expense accounts:

- 5001 – Rent/Mortgage

- 5100 – Office Supplies

- 5200 – Meals and Entertainment

- 5300 – Fundraiser Supplies

Best Practices for Creating Your Chart of Accounts

1. Create only what you need

If you don’t have any debt, don’t worry about creating liability accounts. Likewise, if you don’t own anything outside of the money in the bank, don’t worry about fixed assets. Your nonprofit’s chart of accounts is completely unique and should be tailored for your organization alone. You will always be able to make changes and adapt if needed.

2. Find the right amount of detail

The purpose of accounts is to accurately record transactions, which will allow you to generate accurate reports. Therefore, you’ll want to think through what information you are going to track. This will take some time, and you will most likely make changes down the road. Keep it detailed enough to give you the information you want without being so complicated that it’s impossible to use.

3. Don’t be afraid to make changes

You will need to change things. For example, you may want to break an account into multiple items, or realize you don’t need to track something like you originally thought. Again, your nonprofit’s chart of accounts is unique to your organization, so don’t be afraid to make it exactly what you need.

Next Steps

Accounts are the foundation of any accounting system. Start creating your chart of accounts, or if you have existing ones, you may want to revise them. After that, go through each main type of account (asset, liability, equity, etc.) and write down the sub-accounts your organization moves money in and out of. Above all, the more granular your accounts are, the more granular you’ll be able to run your financial reports.

Once you have accounts set up, we’ll look at how to use a general ledger to record transactions. We will discuss all types of transactions, learn how to use accounts properly, and take a look at other details you will want to record.

Lastly, if you’re using a for-profit accounting product like QuickBooks®, you may run into some troublesome issues as you dive deeper into true nonprofit accounting. Take a look at our review of QuickBooks® For Nonprofits.

12 comments

Great materials and guides to non-profit finance managers.

Thanks for your support, Wilberto! Let us know if we can help you out with anything!

I just had to commend Alex on his presentations. He truly does do a great job on simplifying complicated things; especially fund accounting. I loved how he explained how the cash GL account works with funds in the “Getting Started with Aplos Accounting” YouTube video. Thank you. 🙂

[…] Have three minutes to watch a video version of the lesson? Check it out in Academy […]

[…] three minutes to watch a video version of the lesson? Check it out in Academy Have a larger church with some more complex chart of accounts problems to resolve? Check out this […]

I have a client that is non-profit. They are a daycare. I only reconcile their account. But she wants to set-up an account to code fundraiser monies received for playground equipment. What number code would that fall under? 3300’s?

Great information. Thank you for any assistance.

If the money needs to be separated from other allocations of money, they would want to set up a fund for the playground equipment. Then, as they receive money, they can use the income accounts they already have (i.e. “Contributions Income”) and assign the amount received to that fund. If they don’t want to create a specific fund, but want to see what’s come in, they could create an income account called “Playground Equipment Donations” and then assign it to whatever fund they prefer.

Hope this helps!

We are interested but we would need to know cost before signing up for a free trial.

My Company has more than one project how I can adjust payroll for each project

What is the cost of your product

Hi Louis,

You can find the pricing info here: https://www.aplos.com/pricing. If you have any questions, feel free to email support@aplos.com.

– Janie

I am finance manager of a condominium association. The Primary activity is grounds maintenance, building maintenance and capital improvements. This service is provided to the condo owners and they in turn pay HOA fees monthly.