If you’re looking for a payroll solution, Aplos works with Gusto. With this partnership, you can process payroll and easily record it in your accounting. If you sign up with Gusto using this link, you will receive three months free!

You can also import your payroll from ADP, Pathways, PayCycle, or Sage. Or you can track your payroll manually by setting up a payroll expense account and the liabilities needed to retain amounts per paycheck.

Option 1: Importing Payroll Information

Using Aplos’ Journal Entry screen, you can upload payroll files to keep your information up to date. You can upload files from Sage payroll, ADP, and PayCycle. When you run payroll using their software or services, they will provide a file you can upload to Aplos. Once uploaded, you will map the information to your Aplos expense accounts, which will keep everything up to date.

Option 2: Entering Payroll Information Manually

You can use either the Journal Entry screen to enter your payroll information in Aplos, or you can use the Register. At a very high level, payroll transactions can be boiled down into two transactions.

The first transaction is to record the amount paid to the employee(s), the amount being withheld for taxes and other payables, and the overall salary expense. The second transaction involves paying off the withheld liabilities from the first transaction, as well as the employer’s portion of taxes paid.

Before entering transactions for payroll you will want to make sure you have set up all of the needed liability and expense accounts. Let’s go over how this would be recorded using the Register screen in Aplos.

Transaction 1 In The Register

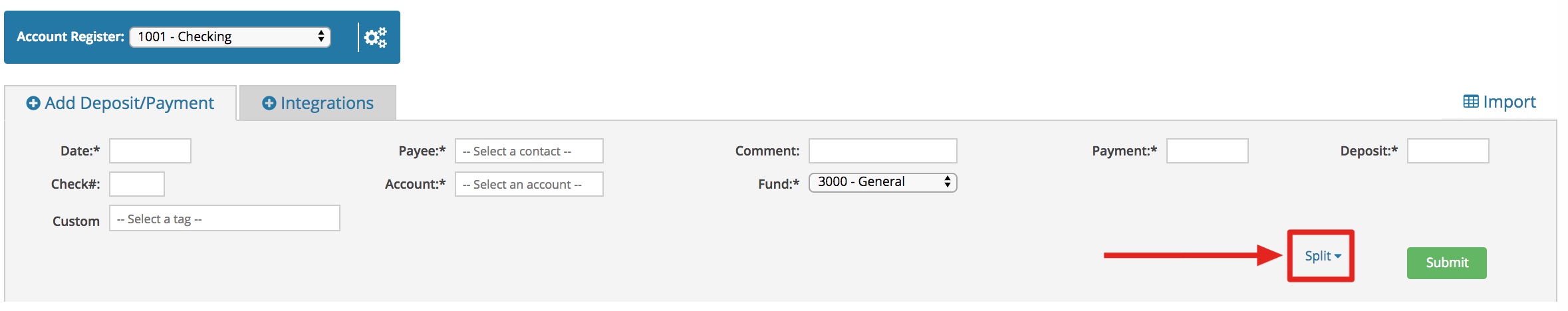

Again, this transaction is recording the amount paid to the employee(s), the amount being withheld for taxes and other payables, and the overall salary expense. When entering this transaction, click the Split button to the very right of the Submit button.

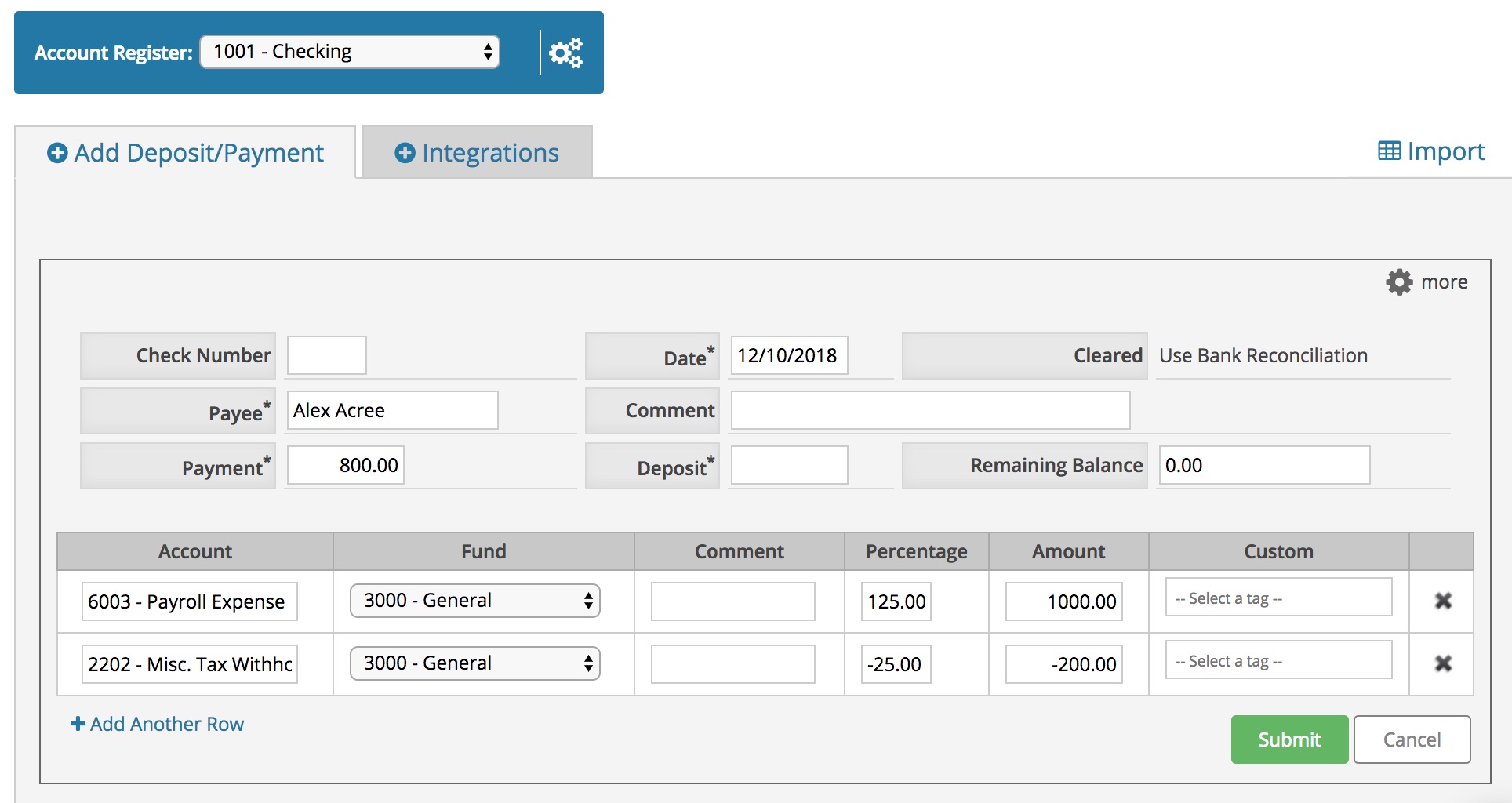

Once this Split screen is open, enter the details of the employee you are paying. Below you will see that we have entered a date, payee, and amount. This amount is the amount being paid out of your bank to the employee.

Click “+ Add Another Row” to add a split line to this transaction. Once added, you will enter the first line for the expense account you have set up for salary. This amount will actually be higher, since it is the sum of the amount being paid out now, and the amount being withheld. The second line is the withholding liability. This is entered as a negative value, which will create a payable value, and allows you to post this transaction in the register.

Click “Submit,” and transaction 1 is complete. Repeat this process for any employee you need to pay.

Transaction 2 In The Register

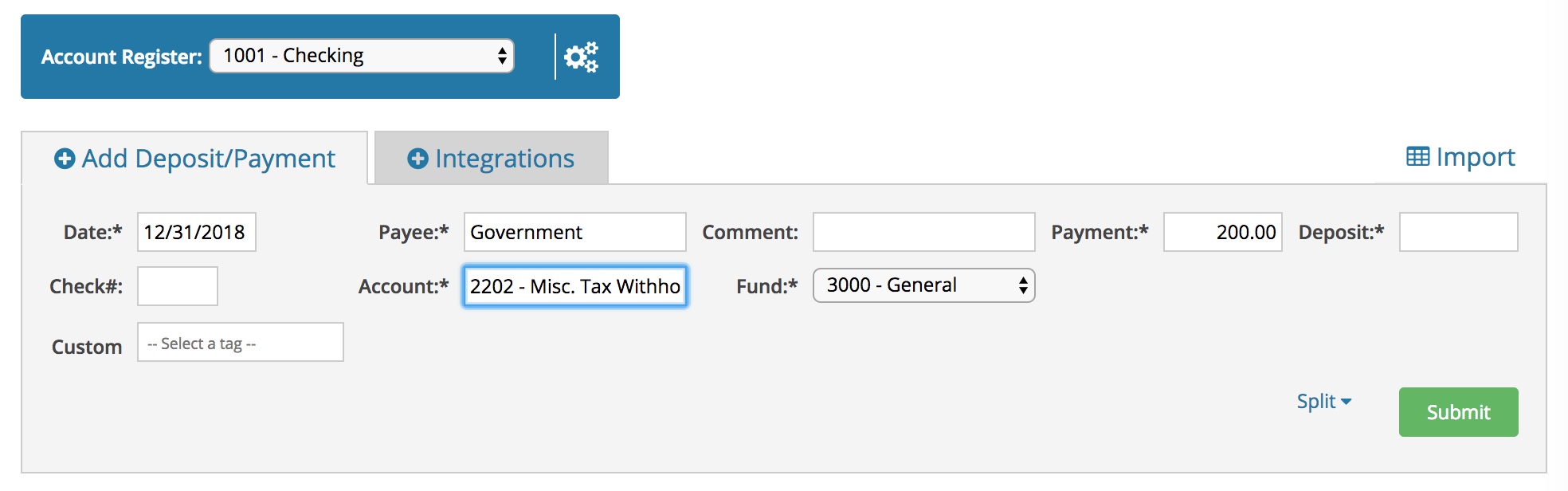

This transaction is the paying off of the amounts previously withheld in transaction 1. This transaction is very straightforward.

See the example above. This is a payment entered to the institution you are paying (payee), in the amount of the withholding(s) from transaction 1. Be sure to select the liability account and save the transaction.

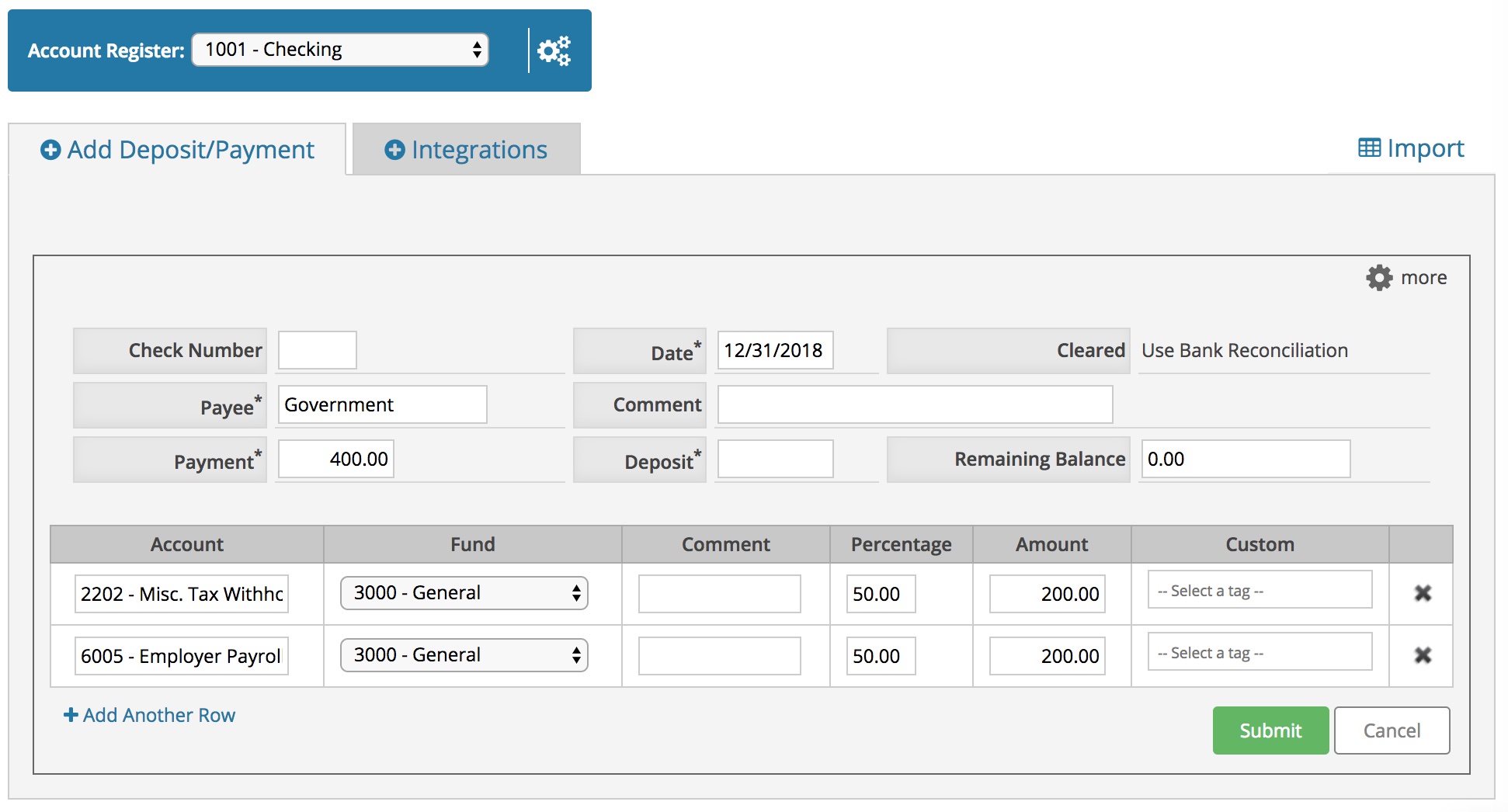

Most likely the amount being paid out is more than the liability, since it also involves the employer’s portion of taxes. So instead of the $200 above, let’s say $400 was actually paid out for taxes. Anything in excess that was previously withheld will likely be the employer portion, which will use an expense account. That transaction is below.

Once this transaction is saved, you have completed your first round of payroll in Aplos! Let’s now take a look at how this would be recorded in a Journal Entry.

Transaction 1 In A Journal Entry

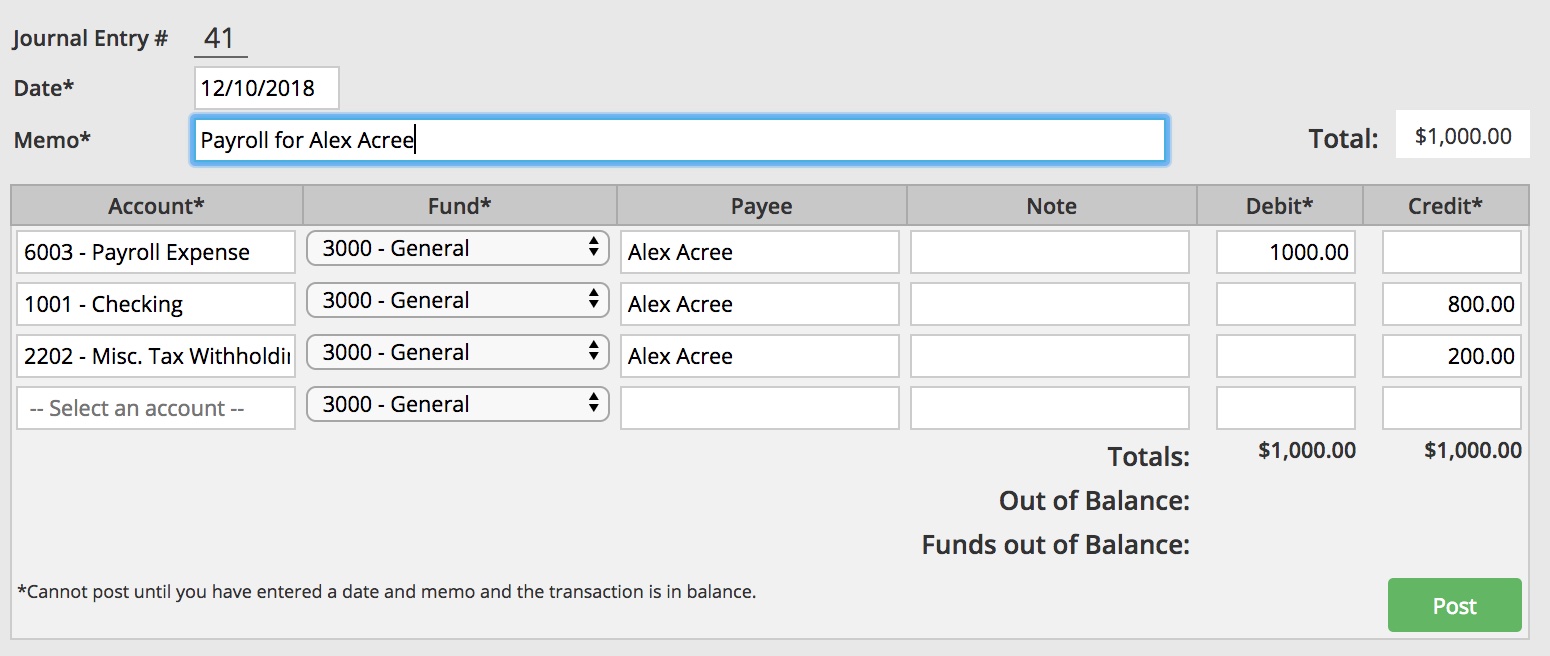

A journal entry requires you to use the debits and credits of accounting to save these transactions. Both journal entry options work for these transactions; it’s just a matter of which one you prefer.

See the journal entry below. This records the total amount of salary expense as the debit value. The amount being paid out of cash and the liability are recorded as credits.

This will update your register for the amount being paid out, and create a payable for the liability withholdings. Now for transaction 2.

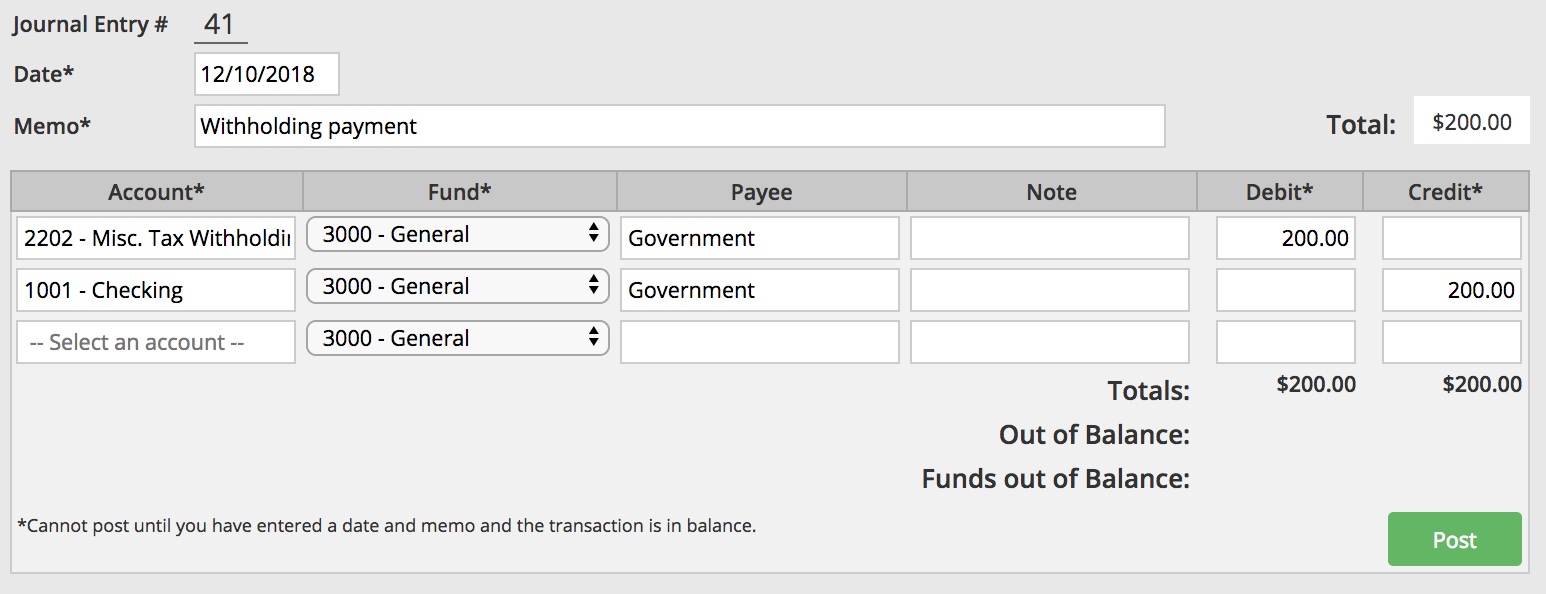

Transaction 2 In A Journal Entry

See the screenshot below. The liability being paid off is recorded as a debit, and the cash paying it is the credit.

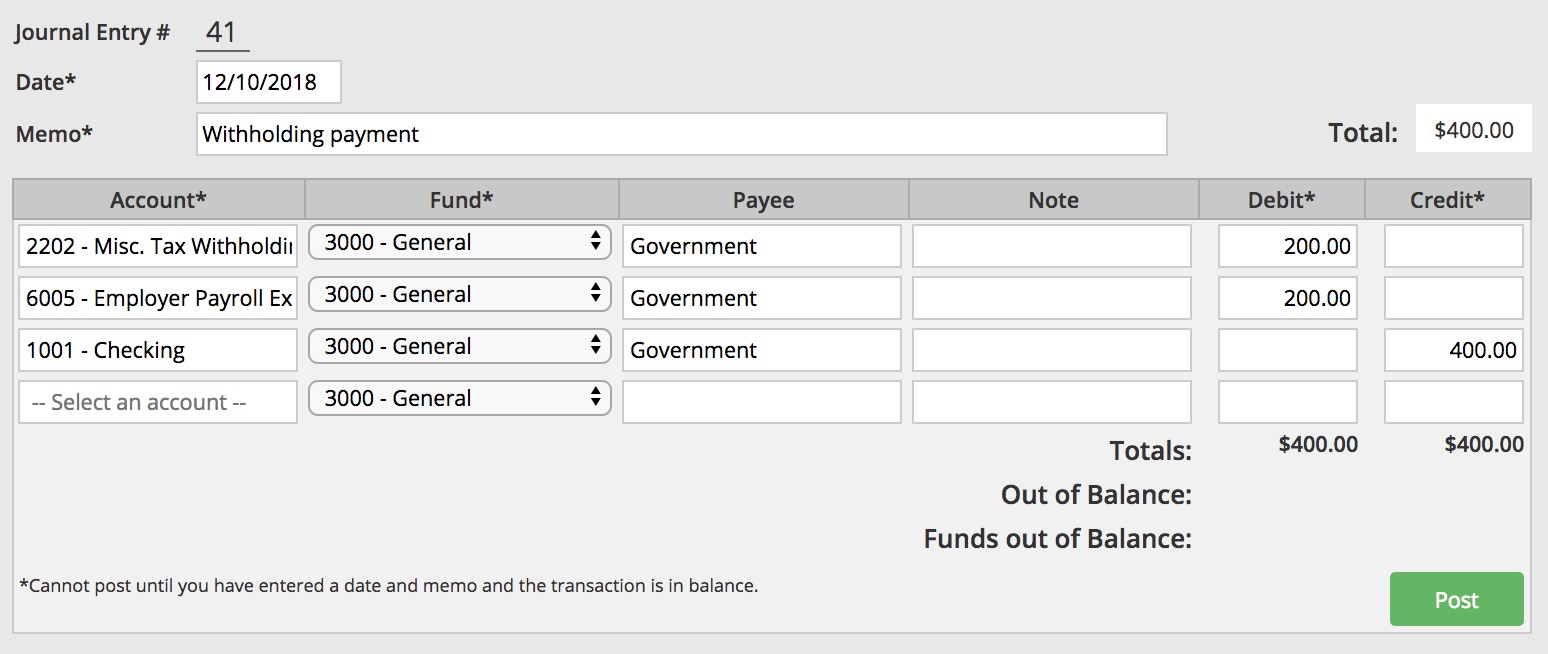

As stated above, the amount being paid out for taxes is almost always higher than the amount previously withheld. The difference in those numbers is going to be your employer portion of tax expenses. That journal entry is below.

When you’re ready to post the entries for your payroll next time, you have the option to duplicate either the transaction in the register or the journal entry. This will make for an even easier process of posting your payroll. Once the transactions are duplicated, you will simply need to enter the new date and double-check your totals before posting.