See what the biggest changes are in Aplos.

https://aplossoftware.wistia.com/medias/epeu1nt25o

Faster Address Updates

The household address update is a recent enhancement that will save you time when updating your addresses. If you have your contacts grouped by household, when you update the primary address for one of the contacts, it will ask if you wish to update all of the other contacts in that household.

Not using households yet? Check out our tutorial on how to create households.

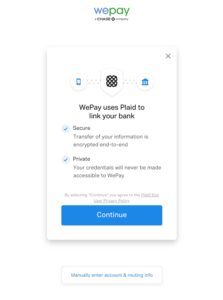

More ACH Giving Options

We now make it easier for your online donors who wish to give using automatic bank withdrawals. Expecting to receive a significant amount of ACH gifts? Talk to our team at success@aplos.com to see if you can qualify for special ACH rates.

Contact Relationship Dates

There is a new way to look at your contacts using relationship roles and relationship dates. In the contact configuration section, you can create custom roles to define how contacts are connected, such as student, member, or employee. In the relationship section of each contact, you can define the relationships between contacts, such as parent, child, or the relationship between spouses. If you have a more formal relationship between contacts, you can also select a start and end date of that relationship so you can log when that relationship was active.

Form 990-N and Form 990-EZ Now Available for 2019 eFile

If you are required by the IRS to submit a Form 990-N or Form 990-EZ, you are in luck! You can submit these annual returns directly within Aplos as part of your subscription. You can find it under Fund Accounting – e-File and Click to “Start New Filing.” For those of you with a January fiscal year start, this return will be due on May 15.

Not sure if you need to file this?

The Form 990-N is for organizations under $50,000 in annual revenue, and the Form 990-EZ is for organizations with less than $200,000 in revenue and $500,000 in assets. If you need to prepare a Form 990 or 990-PF, you may want to upgrade to access the Form 990 tag reports that will help you map your transactions to match 990 categories for easier return preparation. While some churches do submit a Form 990, typically religious organizations are exempt from the requirement. Check with the IRS for more information if you are uncertain if you should file and aren’t sure which form you need.