When it comes to governmentally mandated benefits such as disability insurance and family leave insurance, Gusto does the work for its customers by paying the applicable taxes to the relevant governmental jurisdictions. However, there may be instances where you, as a customer of Gusto, will have to pay your organization’s taxes directly. If you are a Gusto customer with employees in the states of New York (NY) or Hawaii (HI), then this article is for you.

There are three state-mandated benefits that provide you with the option of withholding an amount from your employees to cover a portion of the benefit cost. If you elect to withhold this amount from your employees’ pay, Gusto will withhold it, but will be unable to pay the withheld amount to the applicable benefit provider on your behalf. These are the NY State Disability Insurance, NY Family Leave Insurance, and the HI Temporary Disability Insurance taxes. If your organization withholds the statutory amount for these employee benefits, then you will have to pay these benefit costs directly. Note: This is the only instance where Gusto will be unable to fulfill this duty for you. They will fulfill all other payroll needs.

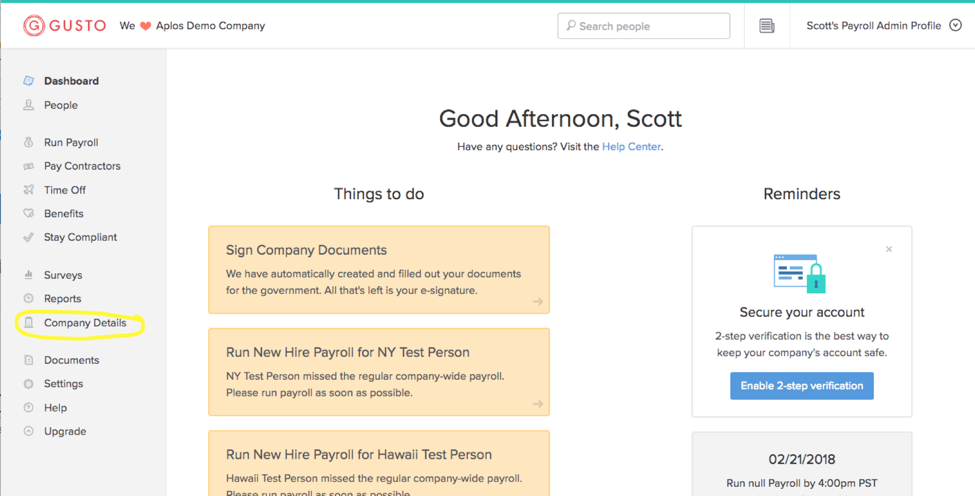

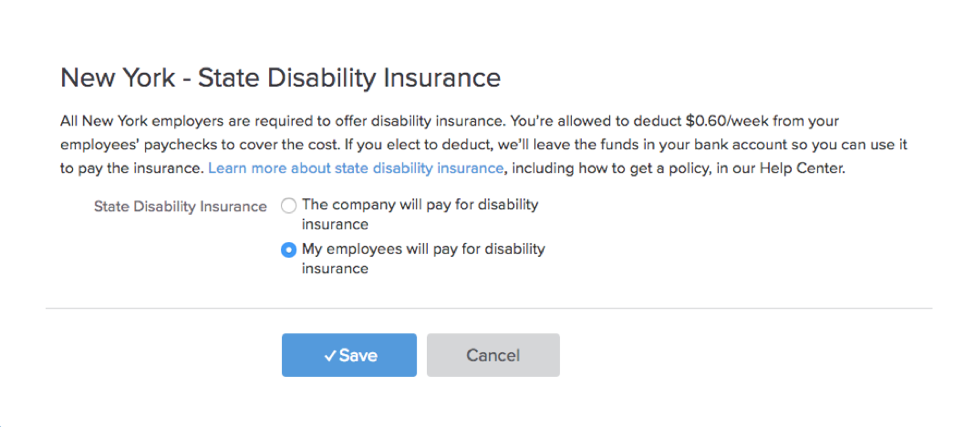

For each of these benefits, Gusto provides you with the option to withhold the allowable amount, or can elect for your organization to pay for 100% of the cost of the benefit, as a service to your employees. This option can be set in Gusto under “Company Details”:

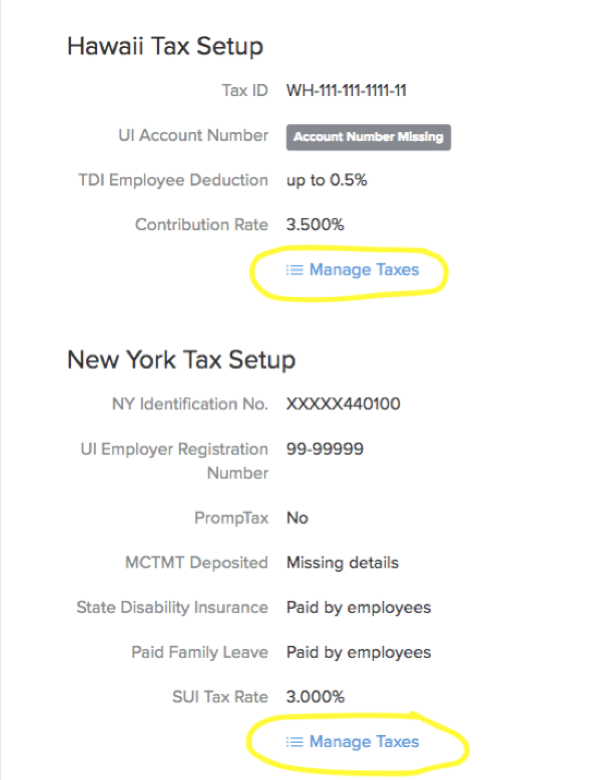

Then select “Manage Taxes” under the relevant state section:

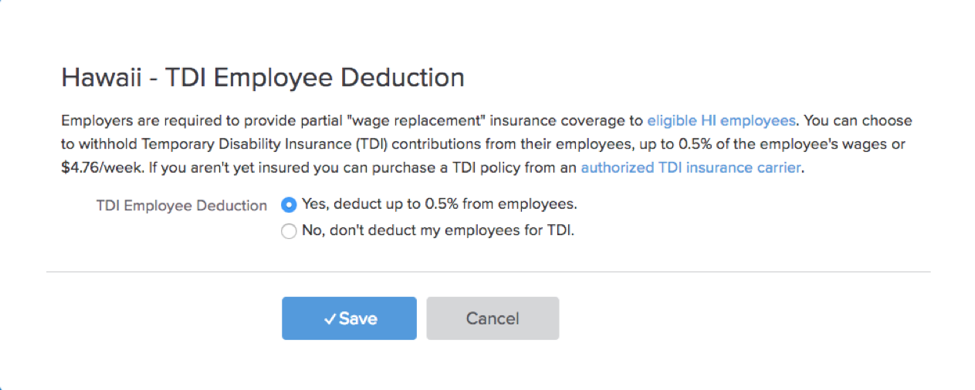

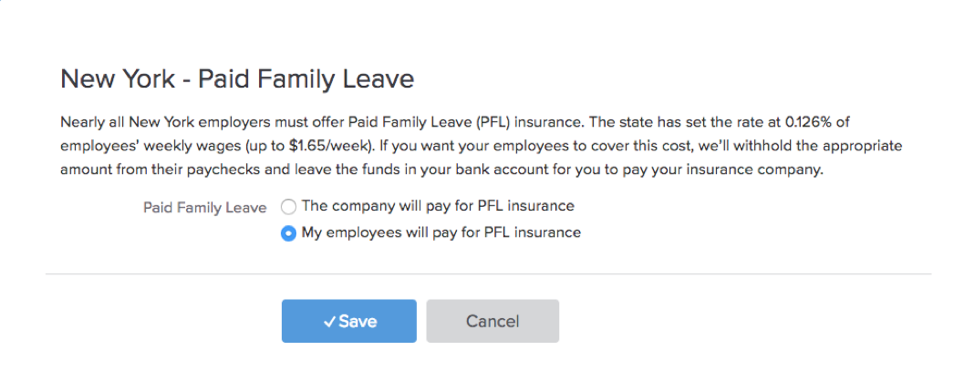

At this point, you will be provided with one of the following options to select:

If you have selected the options as shown in the images above, Gusto will calculate and withhold the relevant statutory amounts for the selected benefit, but not actually withdraw the amount from your account, since they will not be processing the payment. However, when you import the journal entry into Aplos, the amounts withheld under the above selected benefits will be included in the “Taxes” withdrawal, as if Gusto automatically remitted the payments to the respective agencies (which would normally happen under normal circumstances). Since Gusto will not be remitting these payments on your behalf, you will need to manually reduce the amount shown as remitted to Gusto, then reclassify the amount to an expense account[1] (this would show as a negative, or credit, in an expense account). When you subsequently pay the applicable benefit provider, you will record the payment to the same expense account used in the payroll journal entry. Below is a step-by-step breakdown to accomplish this process.

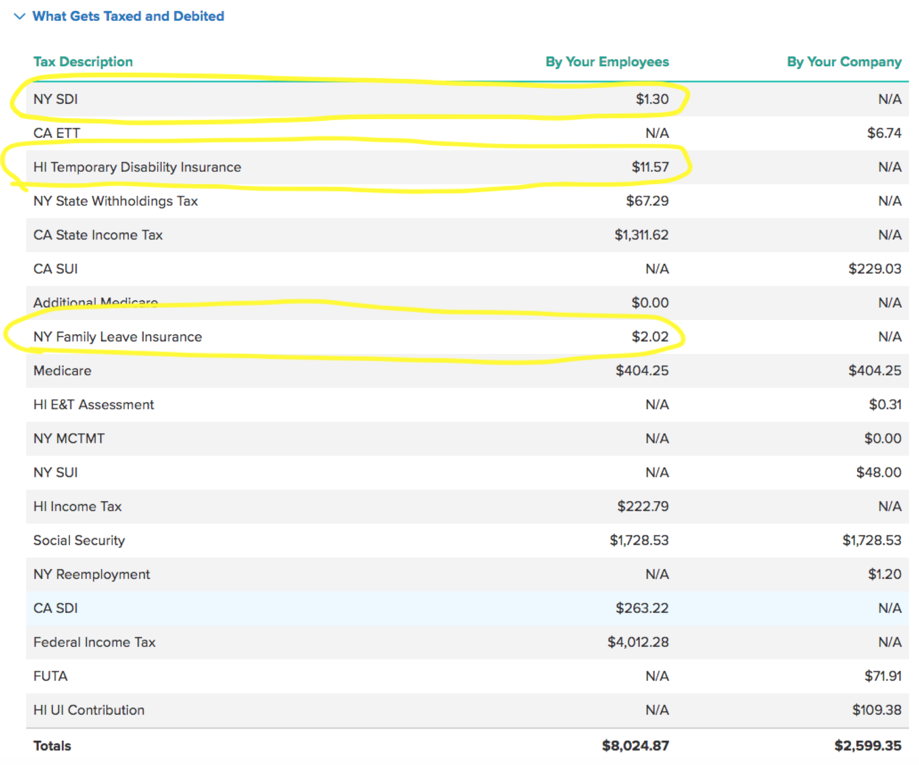

Step 1: Identify Taxes Withheld in Gusto

You can find the amount to reclassify by going to “Reports” in Gusto, selecting “Payroll History” and then “view details” for the relevant Payroll Summaries. You can find all of the taxes withheld from your employees in the section “What Gets Taxed and Debited”. Here you will need to add the amounts in the “By Your Employees” column for the Tax Descriptions “NY SDI”, “HI Temporary Disability Insurance” and “NY Family Leave Insurance”, as shown in the image below ($1.30 + $11.57 + $2.02 = $14.89 in this example):

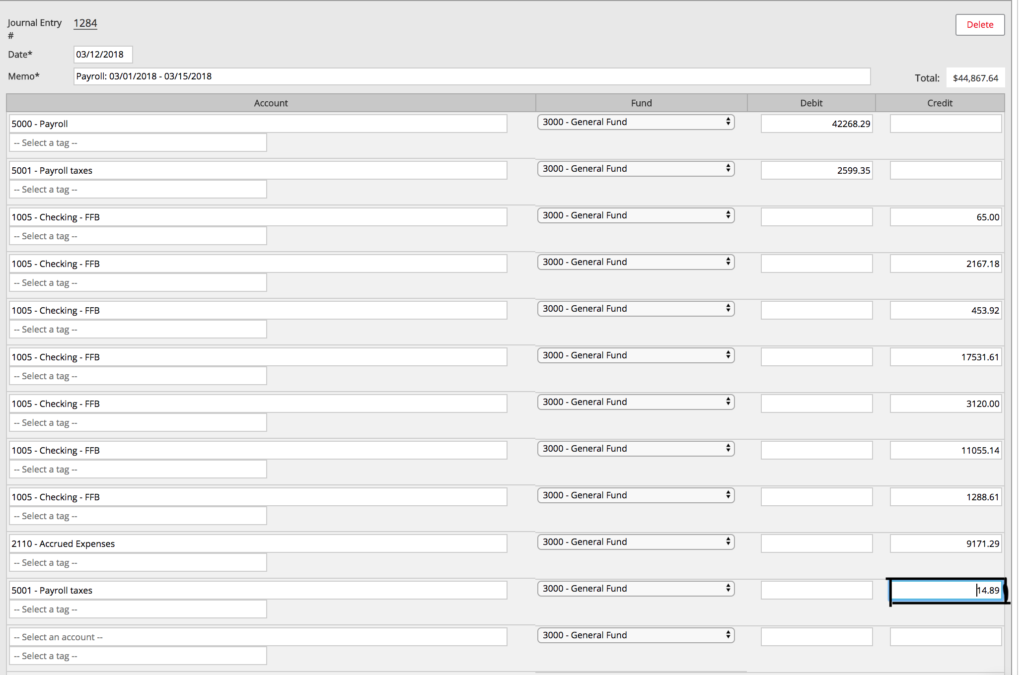

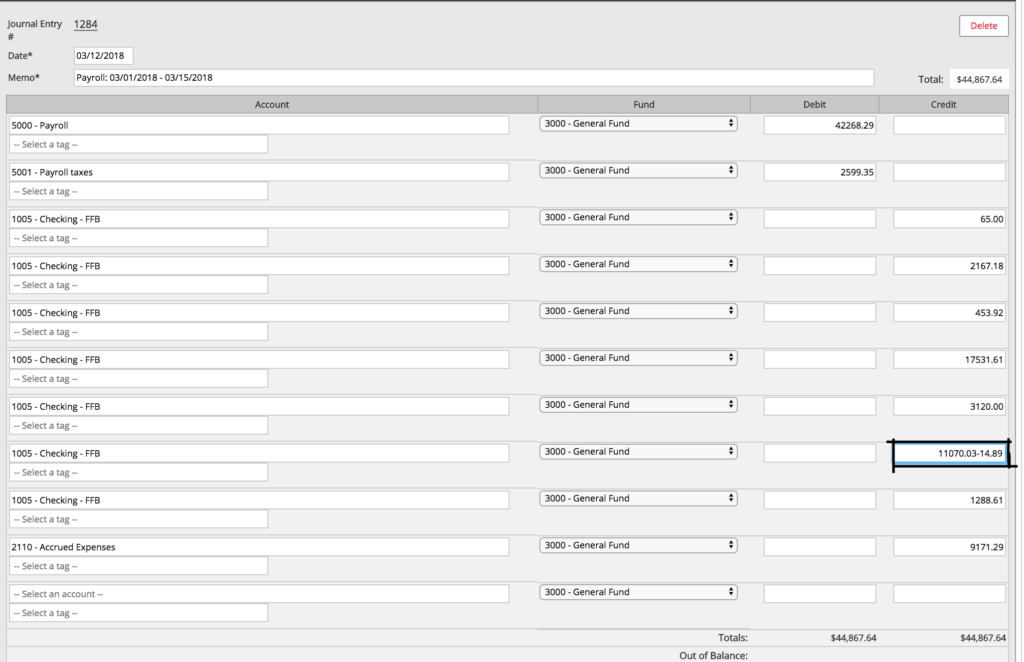

Step 2: Adjust the Journal Entry for the Payroll Withdrawal

The total amount recorded in the Aplos Journal Entry for Taxes is the sum represented in the two columns above. In the above example, it would be $10,624.22 ($8,024.87 + $2,599.35). But the amount Gusto actually withdraws for taxes is $10,609.33 ($10,624.33 – $14.89).

In this example, you would need to find the amount for Taxes in the Journal Entry of $10,624.33 and reduce it by $14.89, to $10,609.33. You would then add a line to the journal entry recording a credit to an expense account for $14.89[2].

Step 3: Pay for the Benefits and Post the Transaction

The final step will be to pay this benefit cost for the state of New York or the state of Hawaii. These can usually be paid through a purchase from any state-approved insurance carriers, or by adopting a “self-insured” plan. Guidelines for providing the NY SDI benefit can be found here, guidelines for providing the NY Family Leave insurance benefit can be found here, and guidelines for providing the HI Temporary Disability Insurance benefit can be found here. Once you pay for this benefit, you would post a transaction for the full amount of the benefit cost to the expense account that you have been crediting with the withheld amounts.

____________________________________________________________________________________

[1] This may not reflect Generally Accepted Accounting Principles (GAAP). If the amount withheld is considered to be material for your organization, you should consult with a Certified Public Accountant as to the appropriate recording of the journal entry.

[2] This example is an overly simplified example with the assumption that you are posting payroll to a single fund and tags are not being used. Multiple tags and funds increase the complexity of the journal entry and our support team will be happy to assist you in addressing the added complexity.