What Is Gusto?

Gusto is a full-service payroll platform, created for those operating organizations such as nonprofits and churches, who have no background in payroll. It can also be self-serviced by employees of your organization. As a user, you can create employee profiles and perform administration on health benefits and workers’ compensation. Gusto can pay employee wages and contractors, as well as state and federal taxes, on behalf of your organization. These are just a few of the features Gusto provides.

Gusto is integrated with Aplos. This means that when you have accounts on both platforms, your organization’s information can sync up seamlessly (as soon as you enable it through your Settings, which is explained below). Your accounting software and your payroll software will be ‘talking’ to each other, removing the disjointed effects that are often a result of using multiple platforms to run your organization.

With a Gusto account, you will also be able to take advantage of other integrated benefits Gusto provides. For example, Gusto works with benefits brokers on behalf of insurance companies, allowing your organization options for benefits that are tailored and priced to fit your needs. They also provide health insurance plans, 401(k)s, HSA, FSA, and commuter plans.

How To Sign Up

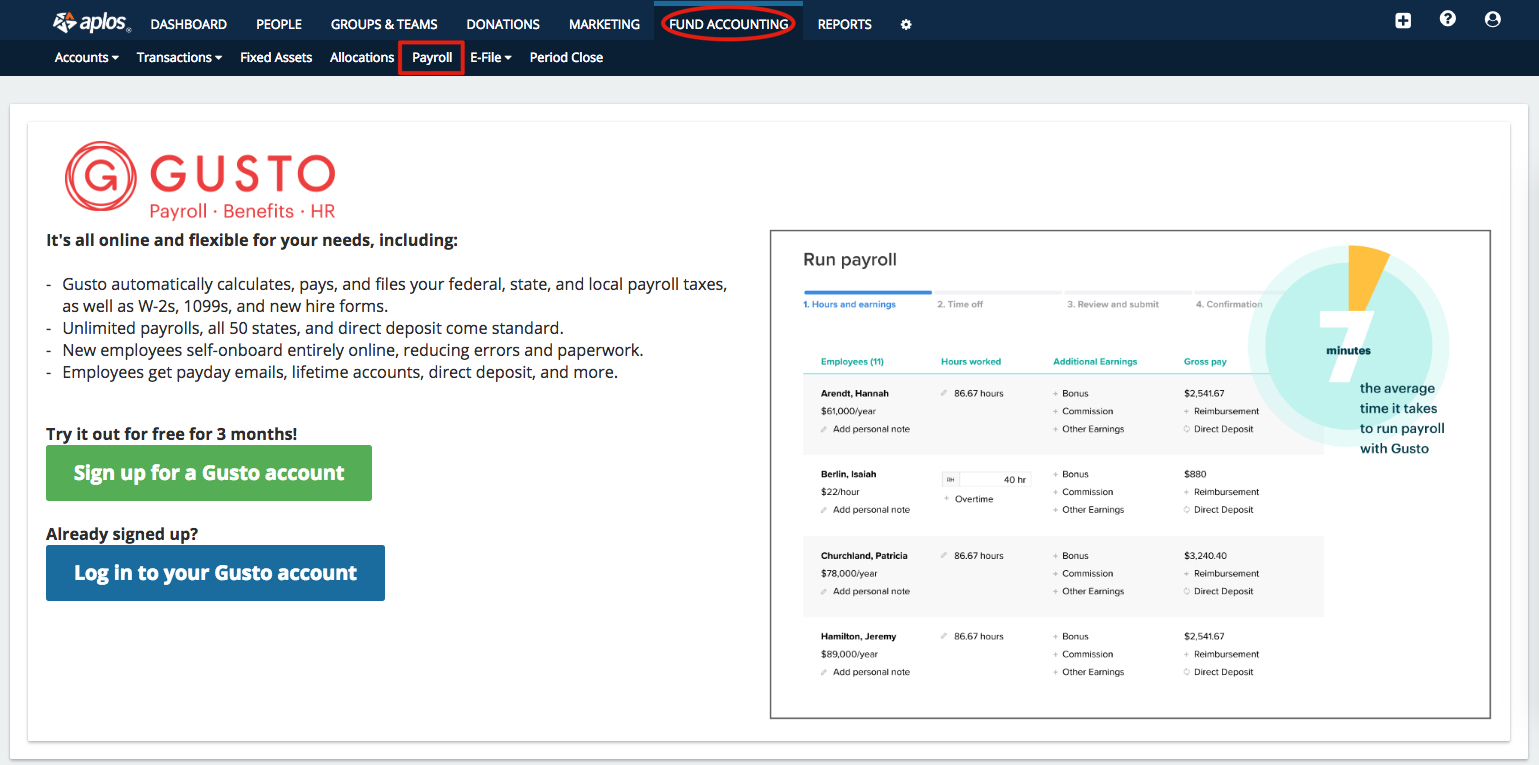

Inside your Aplos account, click on the ‘Fund Accounting’ section, then click on ‘Payroll’. This will take you to Aplos’ Gusto page, where you can either sign up for a three-month trial, or you can log into your existing Gusto account and integrate it with your Aplos account.

Note: You can also sign up through this link: https://www.aplos.com/partners/gusto

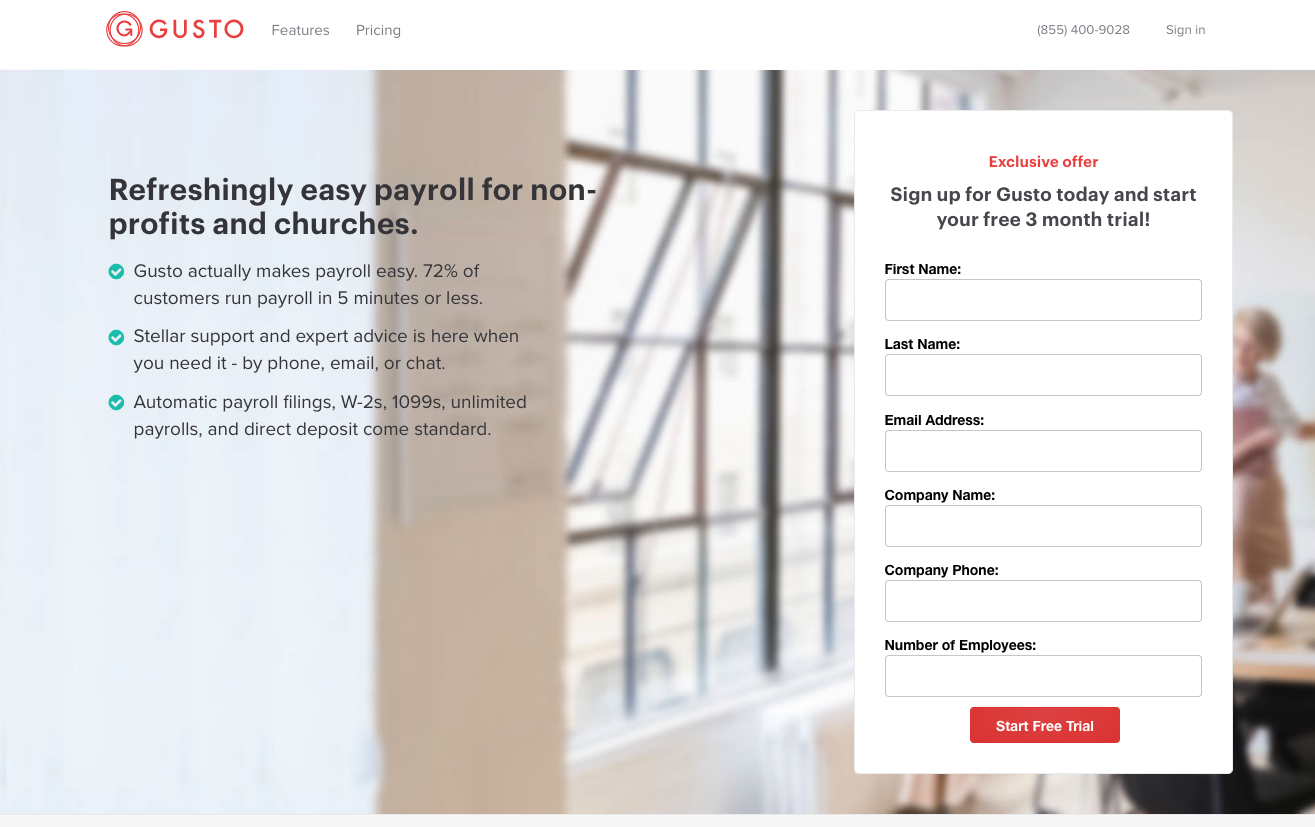

If you are new to Gusto and choose to click on the signup option, you will be redirected to Gusto’s site, where you will sign up for your free three-month trial.

Enter your first name, last name, email address, company name and phone number, and number of employees in your organization. After clicking ‘Start Free Trial’, the following pages will require you to add the state you are operating out of (multiple states can be selected), as well as a password for the account. You will then be asked to verify the account through your email. Once verified, you will be able to sign into Gusto!

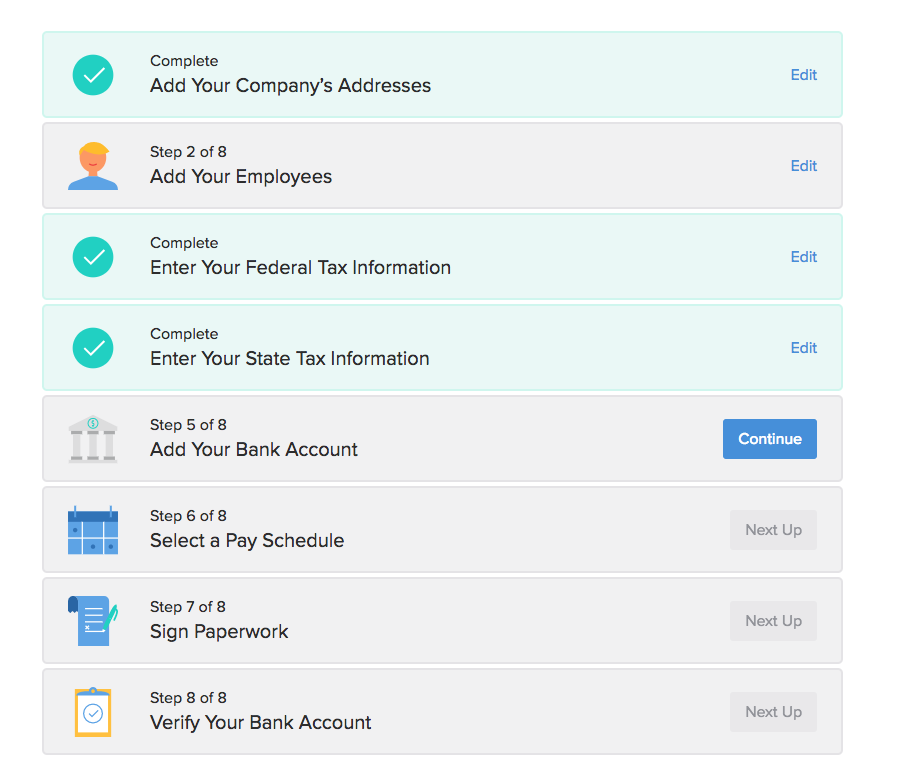

After signing in, you will be shown the eight steps needed in order to add your organization to Gusto. An example of the steps is below.

You will need to add your company’s address, your employees, your organization’s state and federal tax information, your bank account information, and your pay schedule. Once you sign the paperwork and verify your bank information, then success! You will have three months to take advantage of all Gusto has to offer.

Now that you have signed up for Gusto and got it set up, go back to your Aplos payroll page and click the ‘Log in to your Gusto account’ button in order to enter your Gusto credentials. This will link the two platforms. Once that is completed, then congratulations! Your accounts are now integrated.

Payroll Setup

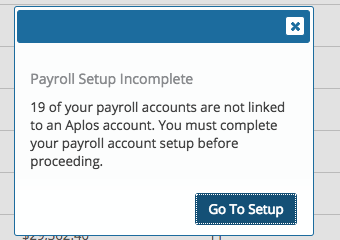

Now, in order to run payroll through Gusto, you will need to set up the proper journal entries within Aplos for when Gusto sends that payroll information to Aplos. Start by clicking on ‘Payroll’ within the ‘Accounting’ section in Aplos. This is the first window you will see:

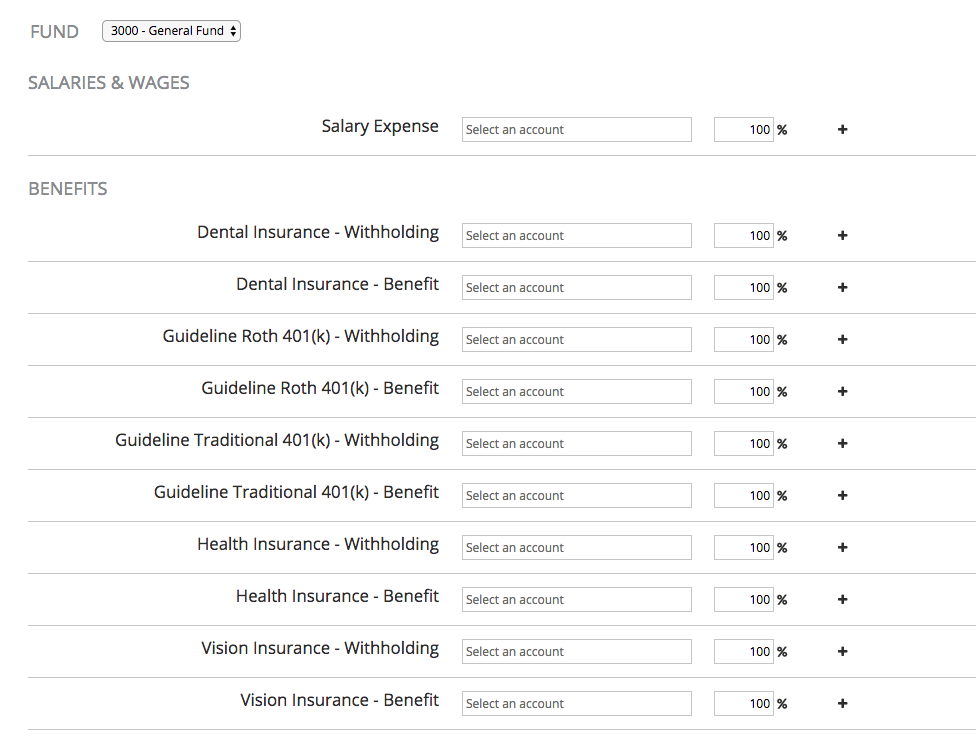

Click on ‘Go To Setup’, and it will take you to this page:

This screen is for mapping out all the accounts from your payroll system for when Gusto imports that data. Select the necessary funds and enter your accounts with the corresponding percentages. If you would like to split an account, click the plus icon on the righthand side for that account. Mapping out every account is required.

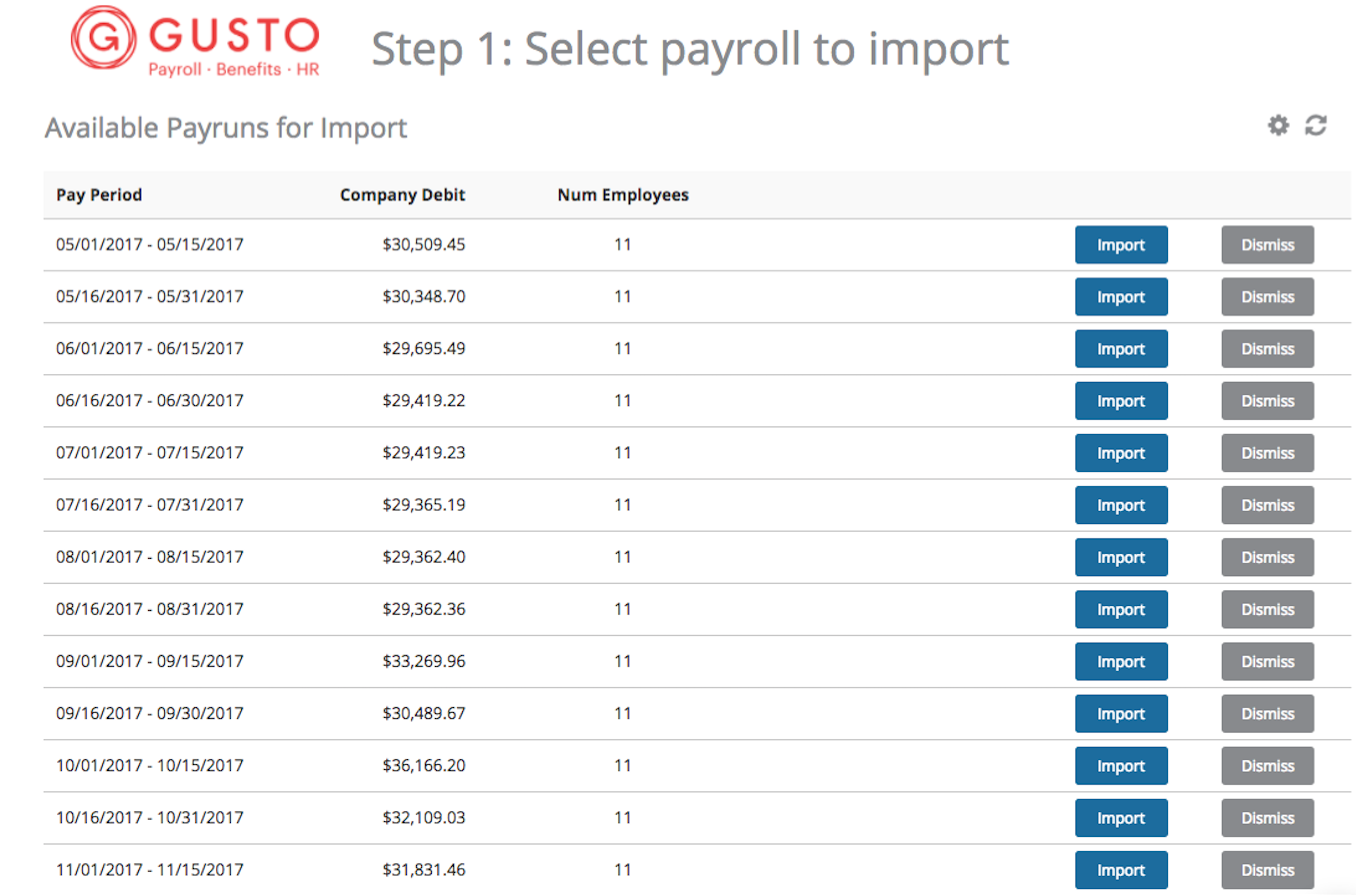

After you finish mapping out your accounts and you click ‘Save’, you will be taken to the list of your organization’s payrolls for you to import into Aplos.

Go through the process of importing any necessary payroll periods, and dismiss the periods you don’t want to import. If you dismiss a payroll period, it will disappear from the list, but you can reactivate it by clicking the ‘Show History’ button at the bottom of the page.

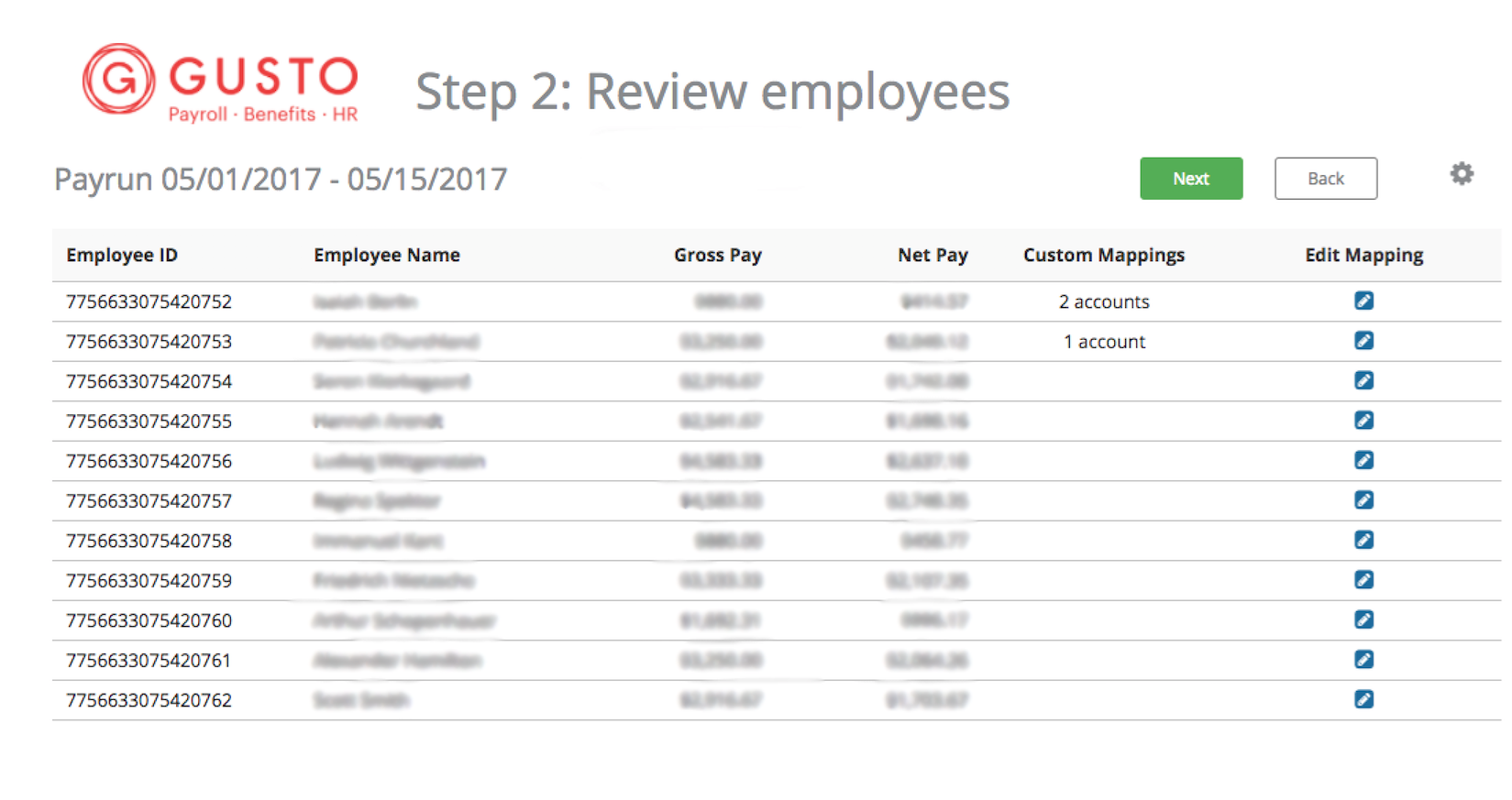

When clicking the ‘Import’ button for any of your payroll periods, you will be taken to a screen with a list of employees who were listed in that payroll period.

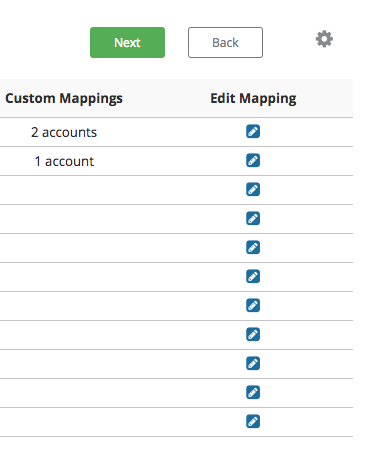

Although you mapped out your accounts in the first step, you can create custom mapping for each employee by clicking the ‘Edit Mapping’ button on the righthand side. The following mapping page will look like the mapping page you filled out for your organization. If you do choose to create custom mapping for individual employees, the number of custom maps will appear in that employee’s row after you save, as seen below.

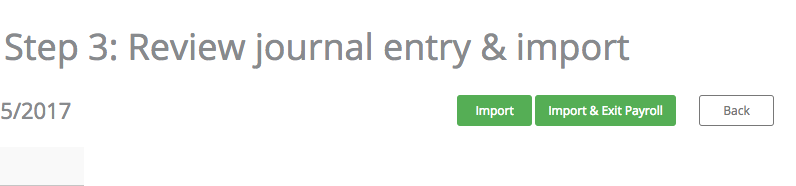

Once you finish, click the green ‘Next’ button. This will take you to Step 3, where you will review your journal entries and then import. You can either Import and remain in the Payroll section, or you can Import and then Exit Payroll.

Once you choose one of these options, then you are done! Your payroll information in Gusto has successfully been imported into Aplos.

Side Note: Creating A Liability Account For Withheld Money

Under normal circumstances, companies pay taxes for their employees when running payroll. Gusto automates this process, making it unnecessary for your organization to set aside funds for taxes. However, for other accounts like retirement accounts, health insurance, etc., your organization will still need to withhold money from your employees’ paychecks to be paid out later on their behalf.

You will need to set up a liability account through Aplos for money withheld for retirement, health insurance, etc.. They will need to be marked as a register as well. By creating these liability accounts as registers, it will allow you to see the current balance, and how the balance is divided up by fund. You will then be able to pay off the liability by using the ‘Pay Bill’ function.

After creating your liability, turn it into a register by clicking the ‘register’ option within the liability. To learn more about creating a liability register, read this article on adding liabilities to your Chart of Accounts.

Other Articles On The Aplos/Gusto Integration