Why Do Bank Reconciliations

Bank reconciliation is an essential tool for every account system for two primary reasons. First, bank reconciliation helps ensure that your bank balance matches your book balance and helps you identify why there are differences. This helps you catch potential errors and improve the accuracy of your books. Secondly, it improves your internal controls by locking down cleared transactions so they cannot be edited without reopening a past period. This process should be done regularly. For most organizations it is a monthly process, but that could vary depending on your needs.

How To Do A Bank Reconciliation

Bank Reconciliation is specifically designed for the purpose of reconciling your bank statement with the information in Aplos. Here is how you would go about completing a Bank Reconciliation. See the step-by-step instructions below.

Start a New Bank Reconciliation

- Access your Bank Reconciliation screen: Fund Accounting > Transactions > Bank Reconciliation.

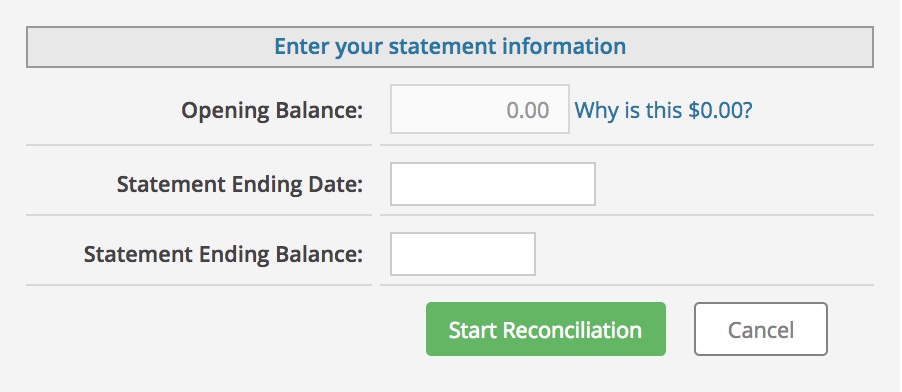

- Pick which Cash account you’ll be reconciling. The opening balance will remain 0.00 for your first Bank Reconciliation. The opening balance will be automatically calculated for all following reconciliations.

- Select the statement ending date. For instance, if you’re looking at a bank statement that ends on May 31, select that as the ending date.

- Enter the statement ending balance. This is the balance of the account at the ending date of the statement. Click “Start Reconciliation.”

Select Cleared Transactions

The transactions shown on the next screen are the entries you’ve entered into Aplos. On the bottom right of the screen you will see your Beginning Balance, and then Checks and Payments, Deposits and Other Credits, and your Statement Ending Balance. As you click through the transactions, you will be marking the payments and deposits as cleared, with the goal of arriving at your Statement Ending Balance.

Here are the steps on how to proceed once you’ve set your ending date and balance (picture below). The best way to go about this is to print a bank statement for the period you’re reconciling and follow these steps:

- Select Cleared Transactions: Check the transactions on your bank’s statement by going down the list. If something appears on both your bank statement and Aplos, check the box next to the transaction and cross it off your paper bank statement. If this is your first reconciliation, you’ll also need to check off your starting balances. If you have not setup starting balances, please CLICK HERE to learn about this process. As you check things off, you’ll notice the difference either increases or decreases.

- Research Missing Transactions: If you find a transaction that does not appear on the statement or in the software, highlight them and do some further research. It’s possible something cleared your bank that was never entered in Aplos or something was entered in Aplos that never cleared your bank. Select “Finish Later” if you need to come back at another time, or “Edit Statement Details” if you need to change the statement ending date or balance.

- Finish Your Bank Reconciliation: To finish and complete a bank reconciliation, the difference must be 0.00. Once you’re finished, click “Finish Now” to complete your first bank reconciliation. When you click “Finish Now,” you can view the report and print or export your completed bank reconciliation.

Congratulations! You’ve finished your first bank reconciliation.

Attach Your Bank Statement

To improve your internal controls and record keeping, attach your bank statement for the closed period to completed bank reconciliation. Under the Attachments column, click the + icon to add your bank statement.

Bank Reconciliation Reports

You can access your current Bank Reconciliation Report from the Report Screen under Other Reports. Your bank reconciliation history is available from the Bank Reconciliation screen. You can select the End Date of the period you wish to see to open or print the Bank Reconciliation report for that period.

Book Balance vs Bank Balance

You may notice that you have a list of uncleared transactions on your Bank Reconciliation Report. They’ll most likely be included in your reconciliation the following month. They also help you identify potential difference between your Bank Balance and Book Balance.

In short, the bank balance is the ending balance appearing on a bank statement. For example, when an organization receives its June checking account statement from its bank, the June 30 balance will be the bank balance.

The term book balance refers to the amount shown in the organization’s records. For example, the book balance listed in your current accounting solution as of June 30 refers to the balance in the general ledger account Cash or Checking Account.

It is typical for a bank balance to not agree with the amount in the organization’s records since some checks written will not have cleared yet or some money received may not have appeared yet on the bank statement. When you perform a bank reconciliation, you identify these uncleared transactions and ensure all cleared transactions were entered correctly.

Changing Completed Bank Reconciliation

Closing a Period

Performing a bank reconciliation will close the period for the cleared transactions tied to that bank account. This prevents the transactions in that period from being edited. Another way to close a period for transactions without performing a bank reconciliation is to use Period Close. You can learn more in this support resource for Period Close.

Re-open a Prior Period

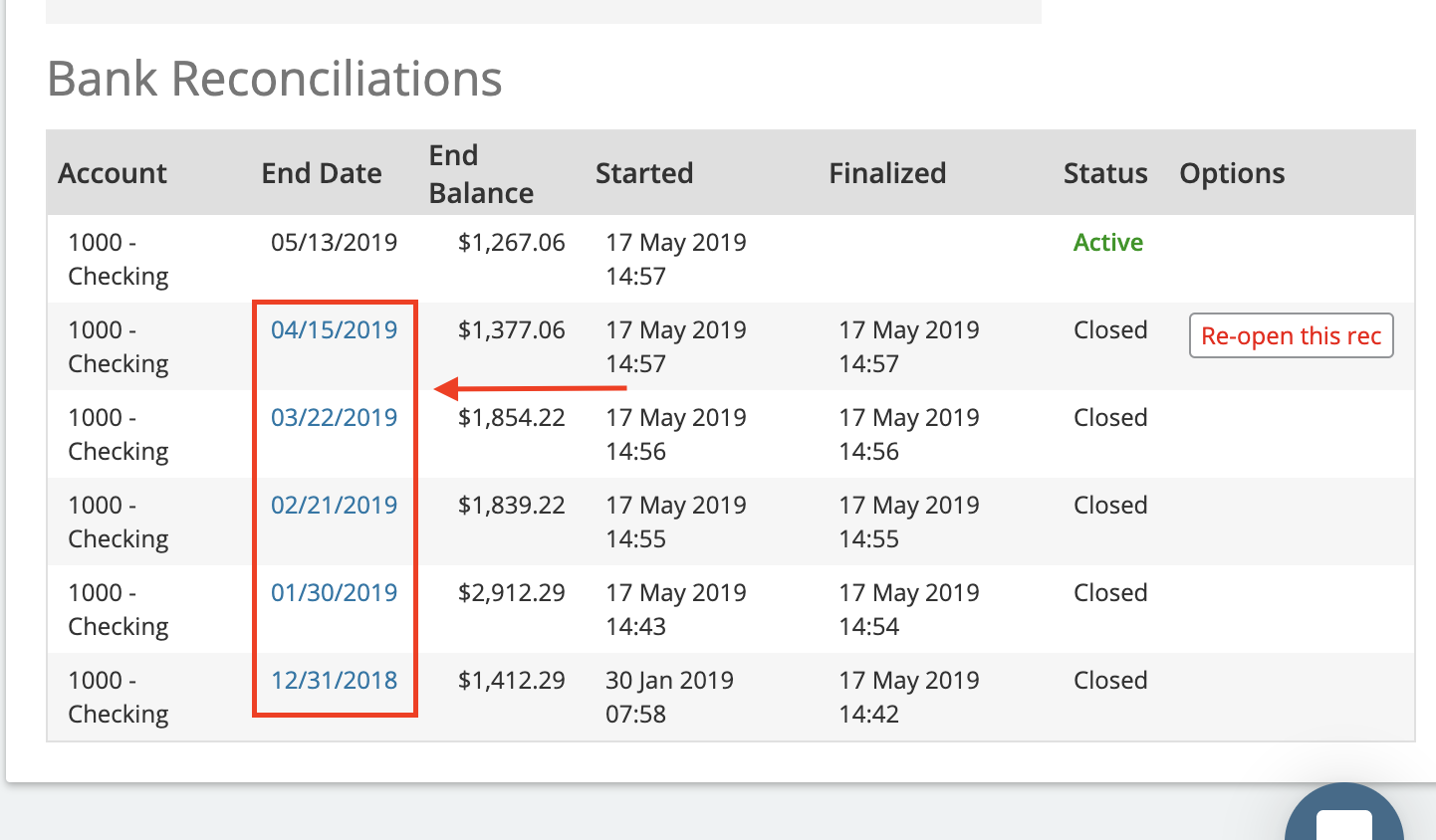

Sometimes you may find it necessary to re-visit, or edit a bank reconciliation that has been previously closed. If you are an administrator, you will be able to re-open a bank reconciliation.

If you need to make changes to your reconciliation, you can go to the Bank Reconciliation screen and click the “Re-open this rec” button (shown below) for the most recent reconciliation to edit details of the reconciliation or transactions.

Note: Re-opening a bank reconciliation will delete any bank reconciliations that are currently in progress for this account, since the change may impact the balances for these periods.

That will re-open that period so that you can make changes. If you need to go farther back, repeat this process until all reconciliations are open, back to the period you need.

Deleting a Bank Reconciliation

If you need to re-open a bank reconciliation that is not the most recent period, you will need to delete all of the bank reconciliations that were completed since that date. This is because changing an earlier period may impact the overall account balance so these periods may no longer be accurate. It may be helpful to print out a Bank Reconciliation report for these period before opening up multiple Bank Reconciliations so you have a hard copy of the Checks/Payments and Deposits/Other Credits for your reference.