This is a process that allows Aplos users to input, or import, payroll entries and also ensure their register lines up with actual bank transactions. This is typically needed when Aplos customers are not using Gusto, and need to input/import payroll summary entries to keep their salary figures up to date.

Example: you may input/import a payroll summary which includes direct deposit, checks issued, and tax payments, all within the same entry. This journal entry would only be one movement in Aplos, however on your bank statement you will see multiple transactions for each check and payment.

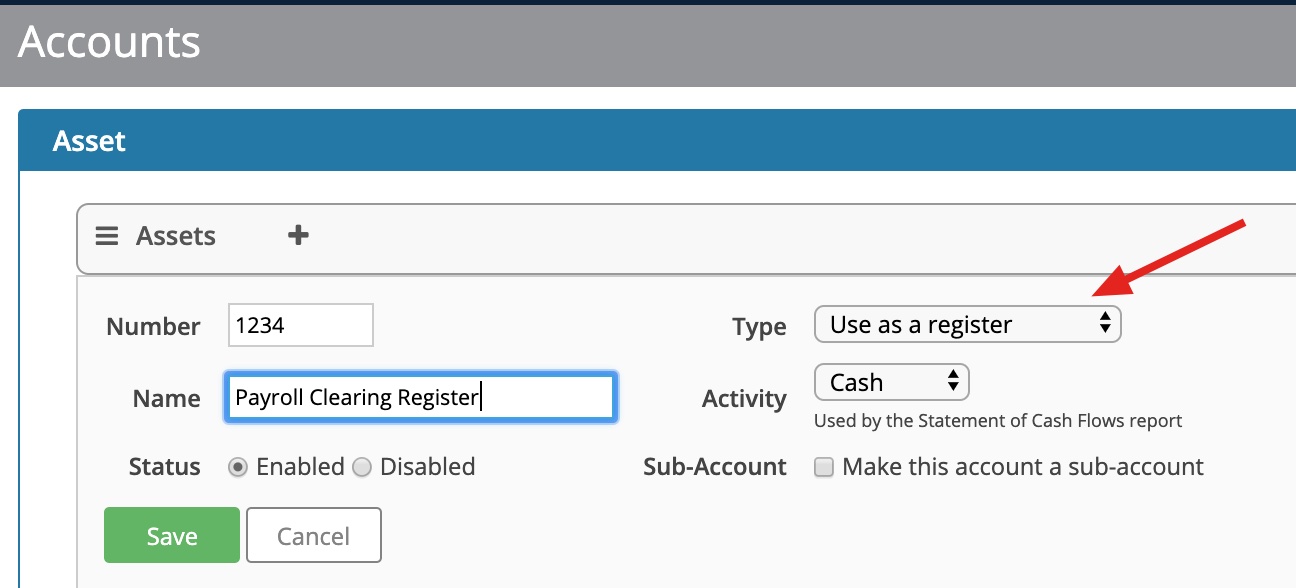

Having a Payroll Clearing Register is the solution. Start by going to your accounts list in Aplos, then to the asset section where you will create an asset account called “Payroll Clearing Register”. Make sure to mark this account as a “register” type account (For more details on the chart of account page in Aplos and making changes, feel free to reference this article).

Using your Payroll Clearing Register Account:

Now that this is created, you will use this register as the place to post your payroll summary entries. The Payroll Clearing Register account works as an intermediary catch-all account that holds the records of all money paid out.

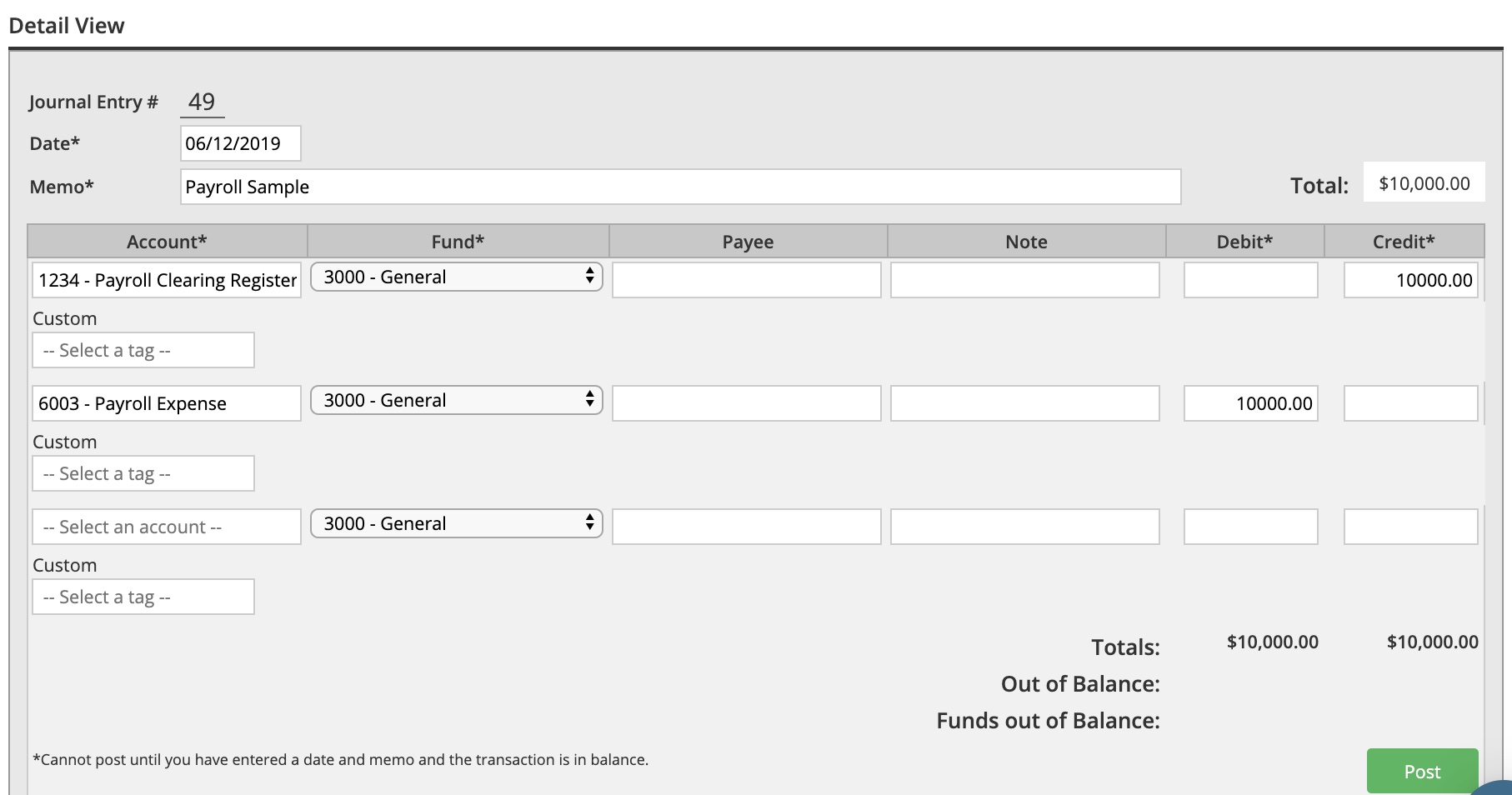

Let’s say you pay your employees a total of $10,000. This $10,000 is actually comprised of four checks for $2,500 each. In Aplos, you will post the receipt of the total payment ($10k) into the Payroll Clearing Register account. Now, instead of showing as a bulk payment in Checking, it shows as a payment in Payroll Clearing Register.

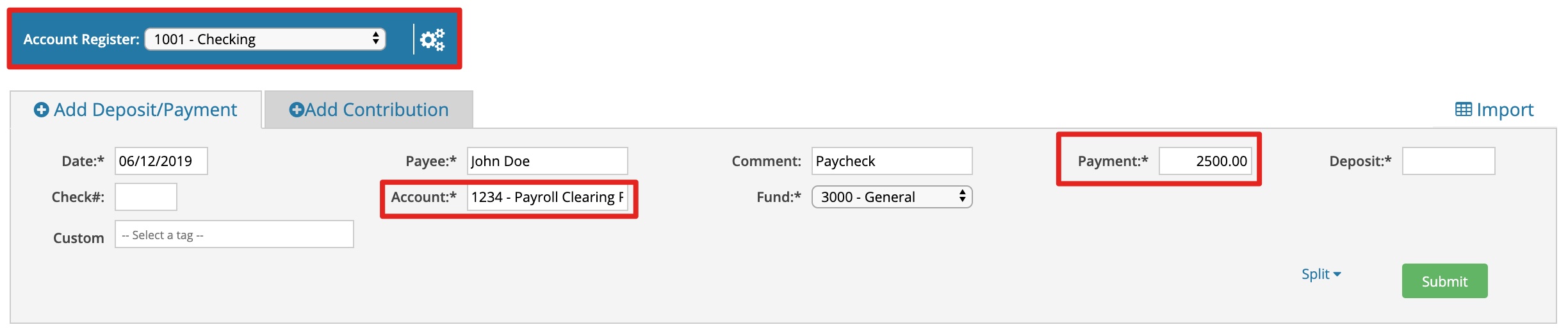

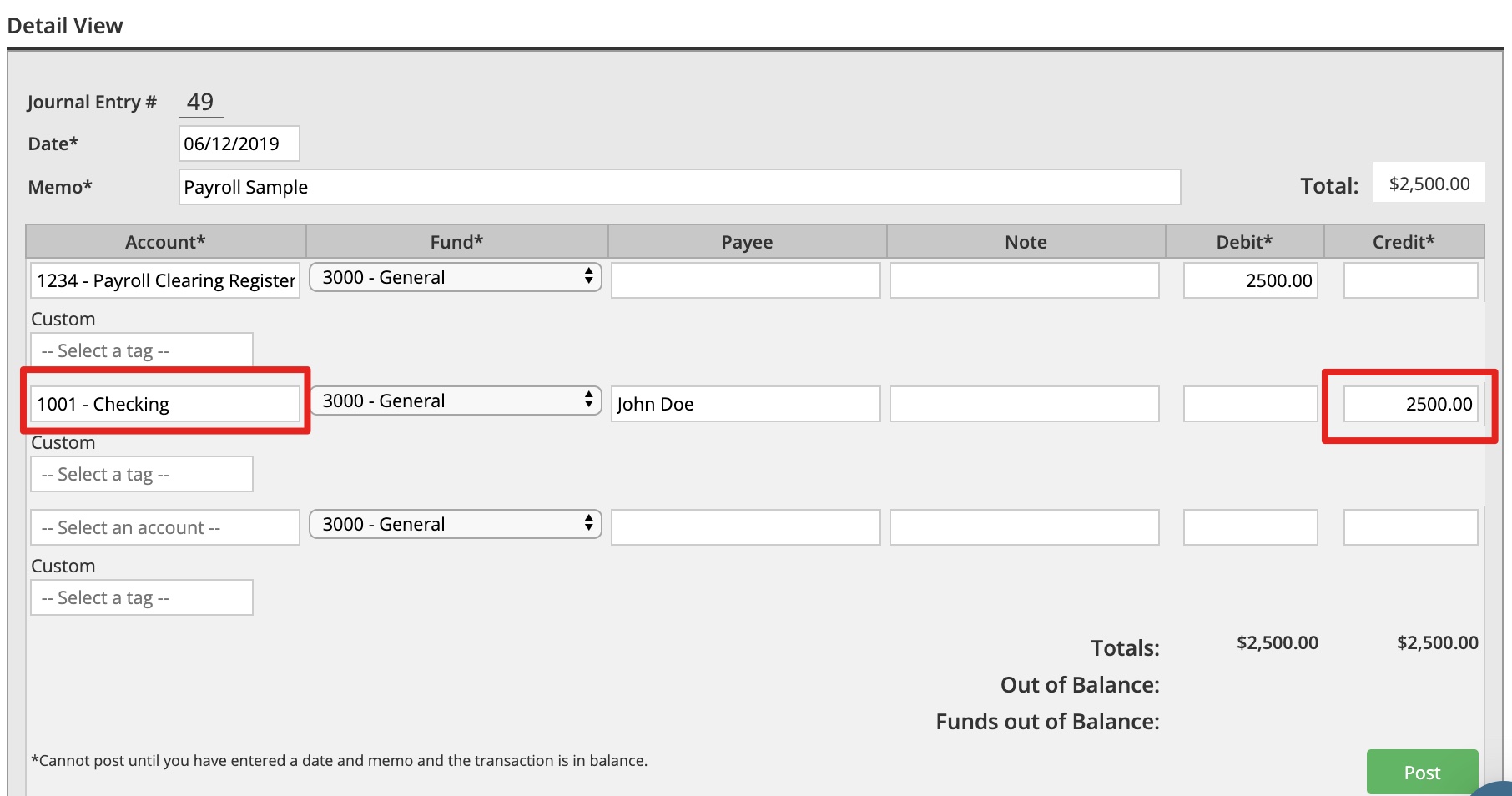

Next, record separate payments in Checking for $2,500 (representing each check), but for the account use Payroll Clearing Register. This can either be done in the Register, or through Journal Entry, and will post as “transfers” from Payroll Clearing Register to Checking.

Register:

Journal Entry:

When complete, the Payroll Clearing Register will be $0, and you will have itemized cash movements in the Checking register. These itemized movements can be cleared on the bank reconciliation when applicable.