If you’re using Expensify to track expense reimbursements, it is easy to record these in your accounting within Aplos. You will use Expensify to track these reimbursements by employee or vendor, and can post a journal entry in Aplos to track these in your accounting.

Exporting from Expensify

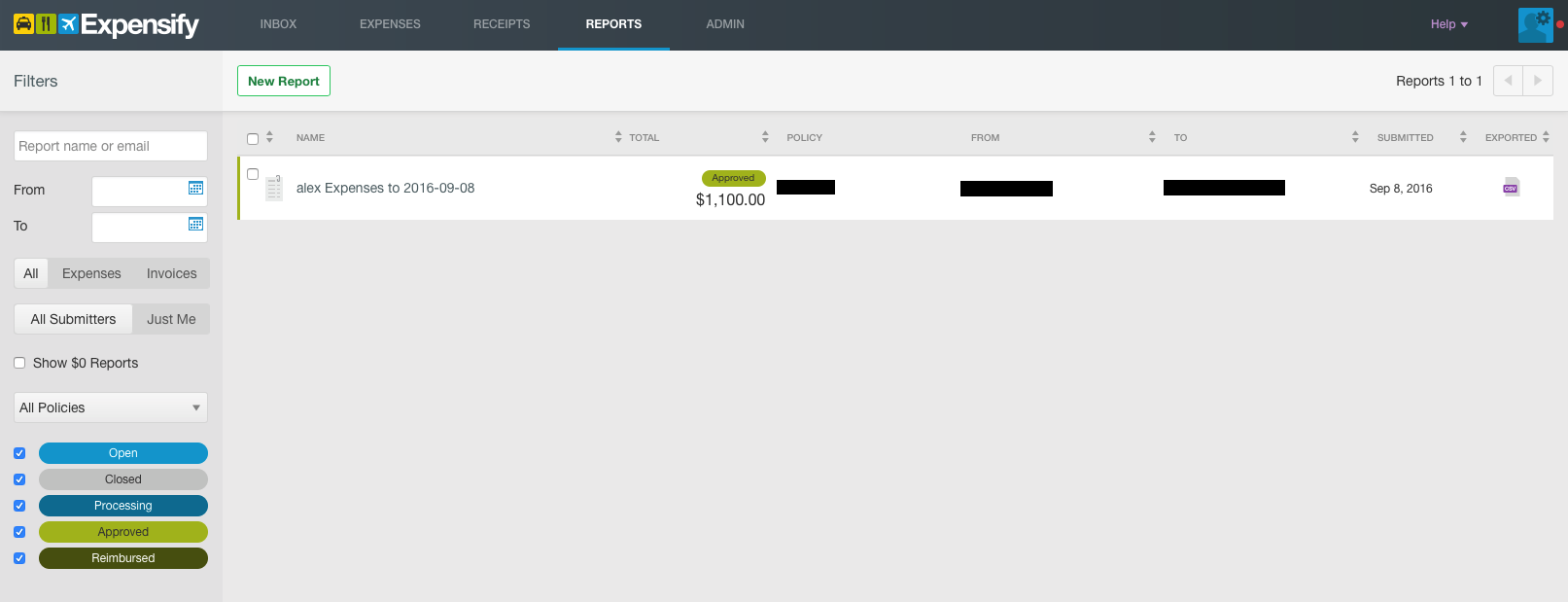

From within Expensify, go to your Reports page to export the CSV of the reimbursement that you need to record.

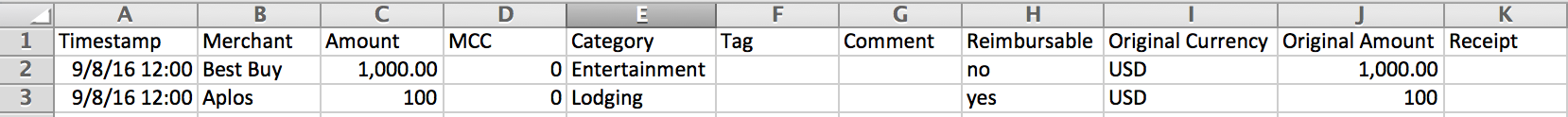

Exporting the CSV will give you the breakdown of the expenses included in your reimbursement. This is what you will use to record your transaction or Journal Entry in Aplos.

Option #1:

The first option is record the expense after you have reimbursed the vendor. The easiest way to accomplish this would be through the Manual Import tool. Take the report that you’ve exported from Expensify, and format it to our manual import template. Then, you will be able to import these to your register to hold the payee info, and all other info for your register transaction. Follow the steps in this guide to assist with utilizing the Manual Import tool.

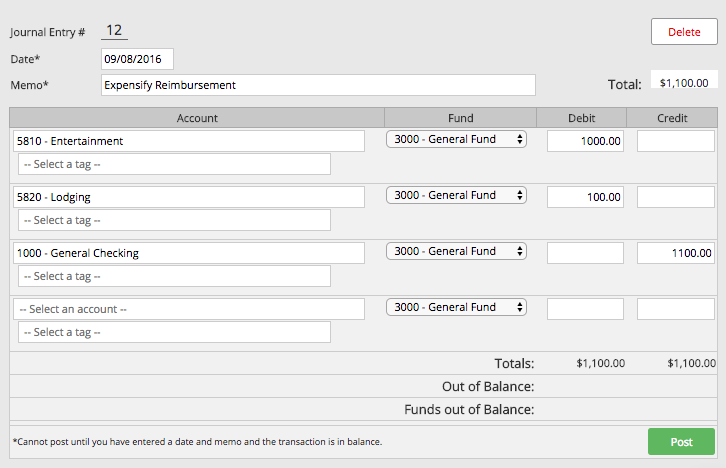

A second option would be to record the reimbursement as a Journal Entry. Using the above example exported from Expensify, you will create your Journal Entry in Aplos similar to the example in the screen shot below. You can create your Expensify Categories to match your GL Accounts in Aplos. Go to Accounting > Transactions > Journal Entry to begin recording the transaction. In this example, you’ll see that the expense account for each is based off of the Category column from the export and the asset account will be your offsetting account:

There is also an option to import a Journal Entry from this page within Aplos. You can see this guide for more information on the process of using the journal entry import tool.

Option #2:

You might decide to record pending reimbursements to track as a liability in Aplos before those are paid to the vendor. If you’d like to go this direction, the following two transactions will show the pending reimbursement as a liability, then the transaction once the reimbursement is paid to the vendor.

Transaction #1: Recording the Pending Reimbursement in Aplos

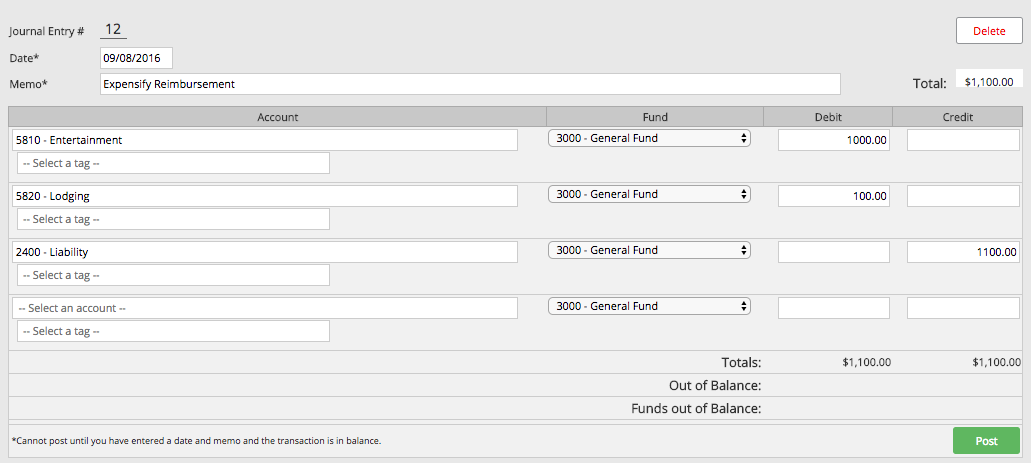

Using the report that you exported from Expensify, you can easily enter a Journal Entry in Aplos to record the transaction for what expenses are waiting to be reimbursed. You can create your Expensify Categories to match your GL Accounts in Aplos. Go to Accounting > Transactions > Journal Entry to begin recording the transaction. Using the transaction example exported from Expensify, you will create your Journal Entry in Aplos similar to the example in the screen shot below. In this example, you’ll see that the expense account for each is based off of the Category column from the export and the liability account for the offsetting account.

This total will reflect in your liability account until you reimburse the vendor and record that reimbursement in Aplos.

This total will reflect in your liability account until you reimburse the vendor and record that reimbursement in Aplos.

Transaction #2: Recording the Payment of the Reimbursement in Aplos

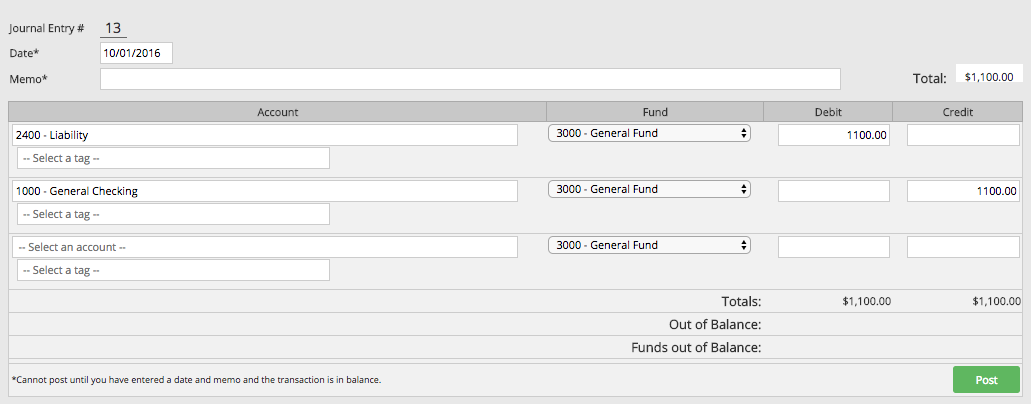

At the point that you pay the vendor back, you will want to post a second Journal Entry in Aplos to pay off the original liability. To do this, you will post a Journal Entry similar to the one in the screen shot below, which will reflect the payment out of the checking account to pay off the liability:

You have successfully posted the expense reimbursement in Aplos! Remember that tracking these by individual will occur within Expensify, so you will access that account to view those details.