Whether you need to record a refund you received or a refund you issued, you can enter these transaction in the Register screen in the Fund Accounting area.

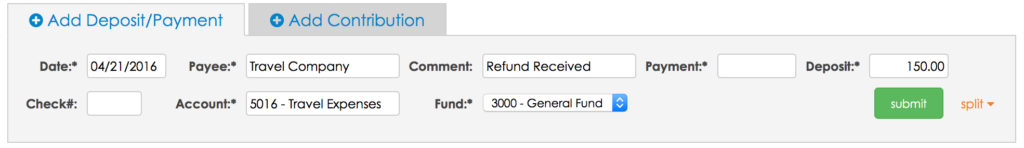

If you have received a refund for an expense that you previously recorded, then you will post a deposit transaction, but you’ll use the expense account that was originally used when you recorded the purchase (instead of an income account as is typically used when recording a deposit). That way, your bank (asset) account balance in Aplos reflects the money returning to your account, but doesn’t show as income because it wasn’t new money received, and also decreases the original expense account used. An example below of how this might look:

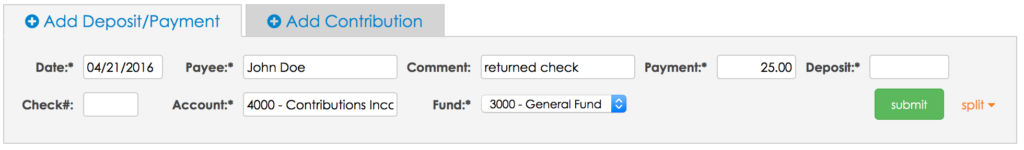

If you need to record a returned check that you had received (i.e. a refund you issued), then you will record the transaction as a payment, but use the original income account that was used to record the income of the check when you received it. An example below of how this might look:

NSF Check

An NSF, or Non-Sufficient Funds check, is a term used in the banking industry to indicate that a demand for payment (a check) cannot be honored because insufficient funds are available in the account of which funds are being withdrawn.

We don’t have a specific process for recording a NSF check, but if it happens you can go back into the batch in which it was posted, and change that donor’s amount to $0.00, or remove it entirely, it’s up to you. That will update their giving record, as well as the deposit total that shows in your register.