Some organizations may have at least a few fixed assets that need to be tracked in accounting. Whether you’re a large organization or small, it is important to know the requirements for tracking your fixed assets and depreciation. Tracking these accurately is essential for good stewardship and accountability.

What Is a Fixed Asset?

A fixed asset is typically an item over a certain value and something you want to spread the cost of over time. Since it brings value to your organization, the cost is spread over its lifetime. Fixed assets are a common item found on a balance sheet in the assets section.

These are long-term or relatively permanent tangible assets, such as equipment, machinery, and buildings, that are used in normal business operations and depreciate over time. Examples include land, buildings, building improvements, equipment, or vehicles. You will determine whether an item is a fixed asset through a capitalization policy and will depreciate the item over the specified depreciable life policy.

What is Depreciation?

Depreciation can be referred to as the systematic reduction in the recorded cost of any fixed asset. Mandated by GAAP, the reason we record this depreciation is so that we can try to match a portion of the cost of a fixed asset to the revenue that it generates. This revenue though is a hard thing to calculate, so instead we calculate the depreciation.

Depreciation is recognized by the useful life of an asset. This is the time period by which the nonprofit expects that the asset will be productive. When the asset is no longer useful, the nonprofit will eventually need to dispose of the asset. Before doing this, the asset needs to be given a salvage value. Depreciation is then calculated based on the original cost of the asset, less any estimated salvage value.

Tracking Fixed Assets in Aplos

Fixed assets need to be depreciated on the balance sheet according to GAAP (generally accepted accounting principles). The assets are shown on the balance sheet at their book value – this equals the purchase price less depreciation. The tracking of this depreciation is called fixed asset tracking.

In Aplos, you have two options for tracking and recording fixed assets. If you use the Fixed Asset module, you can automatically calculate and apply depreciation for your fixed assets. If you track your fixed assets in a spreadsheet or in a different system, you can manually enter the purchase, depreciation, and disposal transactions.

Tracking fixed assets using the Fixed Assets Module

With Aplos’ Fixed Assets feature you can create fixed asset accounts to track depreciation and the value of your assets over a period of time. On your balance sheet, you have the items that you own (assets). These might include items over a certain value that you want to show ownership of and spread out the cost of over time.

For example, you purchase sound equipment for your organization for $3,000. This amount is over the amount of the capitalization threshold your organization has set, which allows you to spread the expense out over the usable life of the item. Instead of considering the full value of the item in the period you purchased it, you can spread that cost out over a period of time.

Setting Up Fixed Assets

Step 1: Link Your Fixed Asset Account

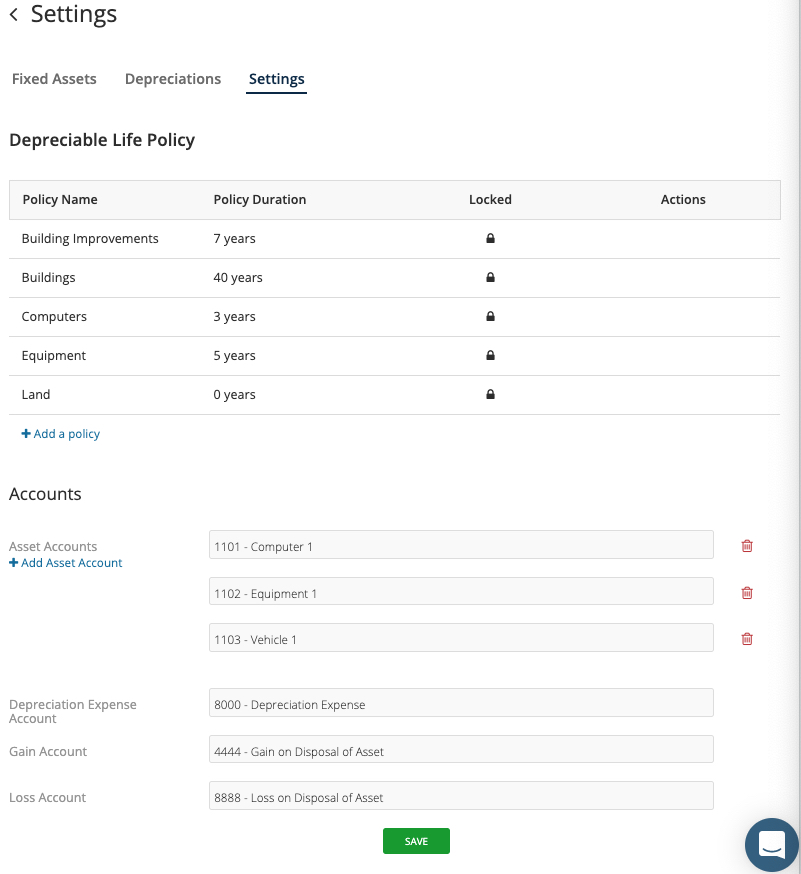

From the Fixed Assets tab, click “Settings.” Under Accounts, search for your Fixed Asset Account and click “Save.” (If you have not previously created a Depreciation Expense Account, you can do so from your Chart of Accounts.) If you are adding more than one Fixed Asset account, click “+ Add Asset Account.” (See Image 1.)

Step 2: Link Your Depreciation Expense Account

From the same page, choose your Depreciation Expense Account and click “Save.” (If you have not created a Depreciation Expense Account, you can do so from your Chart of Accounts.) (See Image 1.)

Step 3: Create and Link Your Gain and Loss Accounts

If you’ve been tracking a fixed asset and you sell it, you need to record whether you made money or lost money on the asset. In your Chart of Accounts, create a Gain on Disposal of Asset account and a Loss on Disposal of Asset account. From the Fixed Assets Setting page, choose those accounts to link them. (See Image 1.)

Image 1:

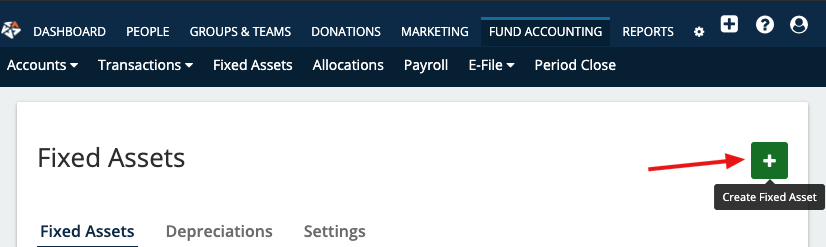

Creating Your Fixed Assets

Now that you’ve linked all of your accounts, you can create the fixed assets you need to track. From the Fixed Assets tab, click the green “+” button to create a new fixed asset. Then record the purchase of your fixed asset.

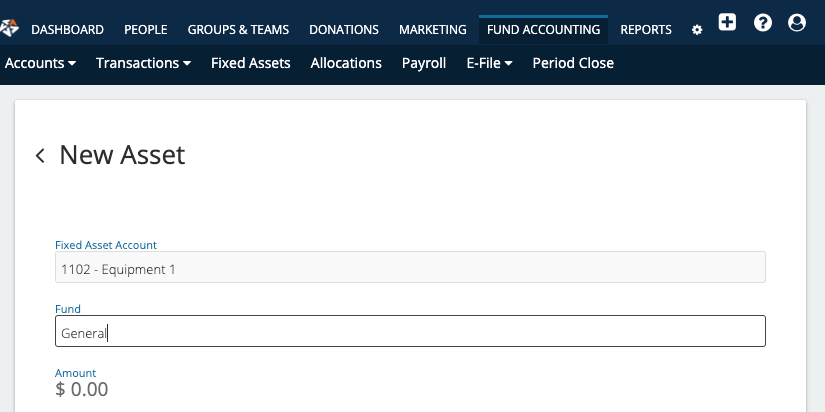

For example, you need to record the purchase of video equipment. Choose the appropriate Fixed Asset account and fund first. Then record the transaction of your purchase.

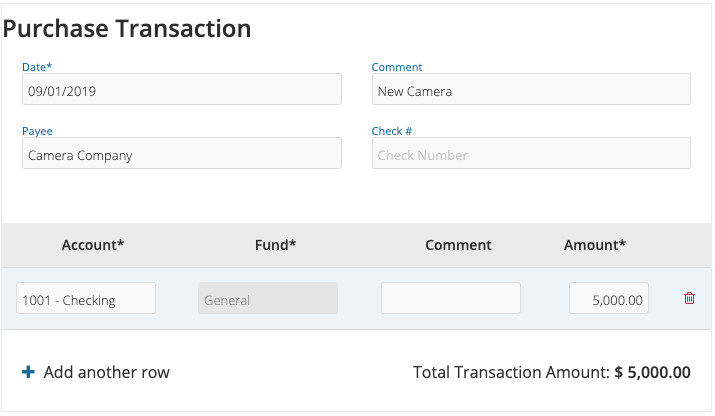

When recording the transaction of your purchase, choose the asset account you used to make the purchase, and record the total purchase amount.

Next, enter the details of the asset. With one total, you may have purchased multiple fixed assets. For example, you may spend $15,000 on three computers, which were $5,000 each. Your Purchase Transaction will total $15,000, but you will create three different assets for $5,000—one for each computer purchased.

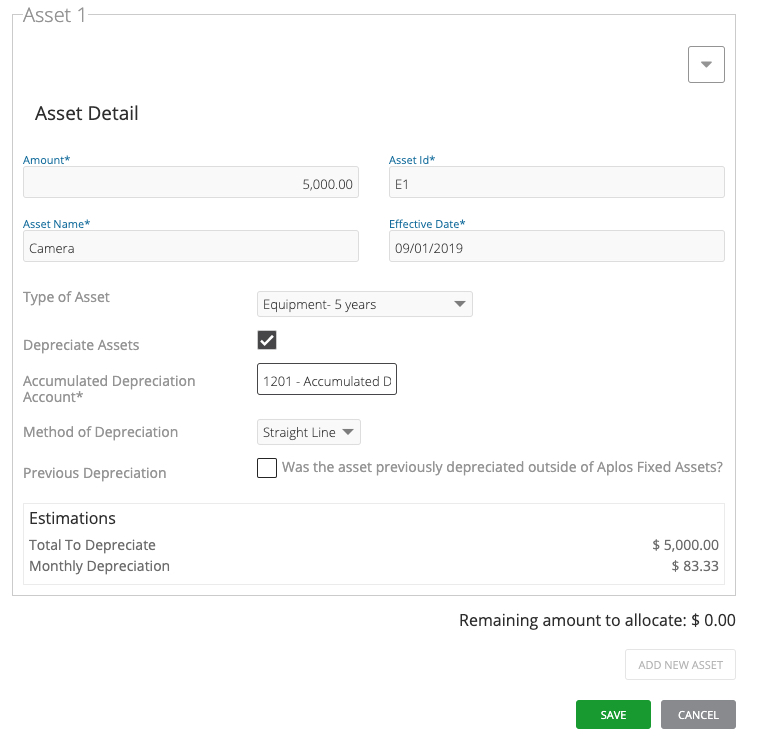

When recording the Asset Detail, you will enter the amount of the asset, the Asset ID (which can contain alphabetic or numerical characters), the Asset Name, and Effective Date (the date the asset will start being used). Select the type of asset, which will determine the depreciation schedule. Then choose your Accumulated Depreciation account and your Method of Depreciation. You’ll see a breakdown of the Total and Monthly Depreciation on the right of the screen.

*If you are new to Aplos and this fixed asset carries over from before you started using the software, you can check the Previous Depreciation option to record that.

When all fields are complete, click “Save.”

Once you have recorded the purchase of your asset, it will appear on your Fixed Assets tab.

Recording Depreciation for Fixed Assets

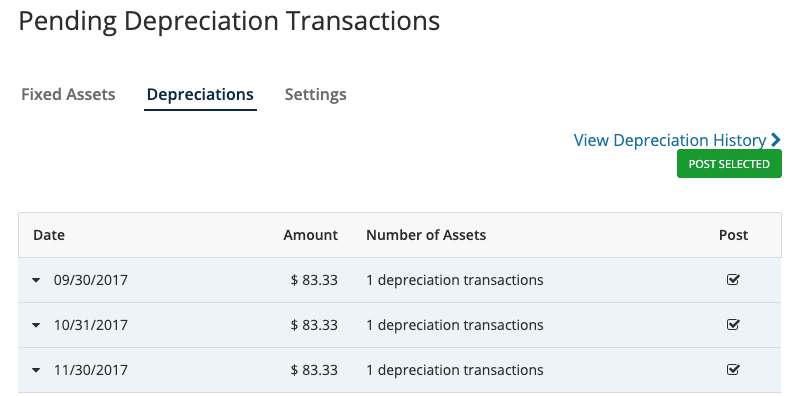

Now you’re ready to record depreciation. The software will automatically factor the deprecation for you and will show each transaction related to the depreciation of that asset on the Pending Depreciation Transactions page. The only action you will need to take is to check over the transaction and then post it. The depreciation will NOT automatically post to your accounting.

Click the option to view details of the deprecation, which will show the related asset. Then check the box next to any deprecation transaction that needs to be posted, and click “Post Selected.” This will post the depreciation as a Journal Entry.

Disposal of Fixed Assets

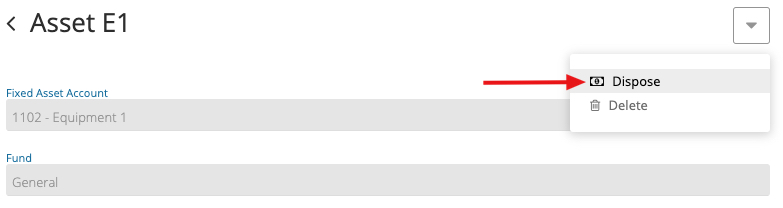

If at any point you sell a fixed asset, you can record the disposal of it in Aplos. You will do this from your Fixed Assets tab. Choose the asset you’d like to dispose of. Click the extra actions arrow icon in the upper right corner. Then click “Dispose.”

This will allow you to enter the amount you sold the item for, which will factor any gain or loss on the asset. Once you click the “Dispose” button, the software will post a Journal Entry for that gain or less on the asset, which will reverse the asset and remove it from your Balance Sheet.

Reviewing Depreciation Schedule

If you have Fixed Assets enabled, you can find the Depreciation Schedule report in the Other Reports section of the Report Screen. This report tracks the accumulated depreciation amount over the span of an asset’s life. With this report, you now will be able to efficiently test your fixed assets and accumulated depreciation in the event of an audit.

Option 2: Manually Entering Depreciation for Fixed Assets

If you do not wish to use the Fixed Asset module, you can still handle Fixed Assets manually in Aplos, we recommend following these steps:

- Create a new Asset account in your Chart of Accounts (https://www.aplos.com/aws/am).

- Enter a Starting Balance for your account on the Starting Balances page (https://www.aplos.com/aws/am/sb).

- Create a new Expense Account for your depreciation in your Chart of Accounts.

- Record your depreciation as a payment entry in the register (https://www.aplos.com/aws/cr).

Note: The information provided here is for educational purposes only and is not intended to serve as professional tax advice for your organization. Be sure to consult a licensed tax advisor if you have any questions.